NPS Calculator: The National Pension System (NPS) is a government-backed social security investment scheme that offers both debt and equity exposure to an investor in single investment. In NPS scheme, an accountholder is given option to choose up to 75 per cent exposure in equities that means NPS accountholders need to keep at least 25 per cent exposure in debt.

However, from experts’ perspective, keeping debt-equity ration in 40:60 ratio or 50:50 ratio for long term is advisable. In this debt-equity exposure, NPS interest rate can be expected around 10 per cent per annum in long term. They said that if a person invests in NPS scheme, he or she would get income tax benefits as well. They said that if an investor invests ₹15,000 per month in NPS account after growing 30 years, one can expect to get ₹2.23 monthly pension after turning 60 years.

On how to get 10 per cent NPS return in long term, Kartik Jhaveri, Manager — Wealth Management at Transcend Capital said, “If a person keeps debt-equity exposure in one’s NPS account in 50:50 ratio, then its equity yield would be around 12 per cent in long tern and debt yield would be at least 8 per cent in long term. As the exposure is in 50:50 ratio, one equity return would be 6 per cent and one’s debt return would be 4 per cent in NPS account. Adding those equity and debt returns, one’s net NPS interest rate earned in long term would be 10 (6 + 4) per cent.” He said that if the NPS accountholder keeps debt-equity ratio in 40:60 ratio, then in that case equity yield would go up to 7.20 per cent (12 x 0.60) and debt return would come around 3.20 per cent (8 x 0.40).

Kartik Jhaveri of Transcend Capital said that NPS accountholders get income tax benefit as well. He said that one can claim income tax exemption under Section 80C on up to ₹1.5 lakh invested in NPS account in single financial year. Apart from this, one can claim an additional ₹50,000 income tax exemption under Section 80CCD (1B) on one’s NPS investments.

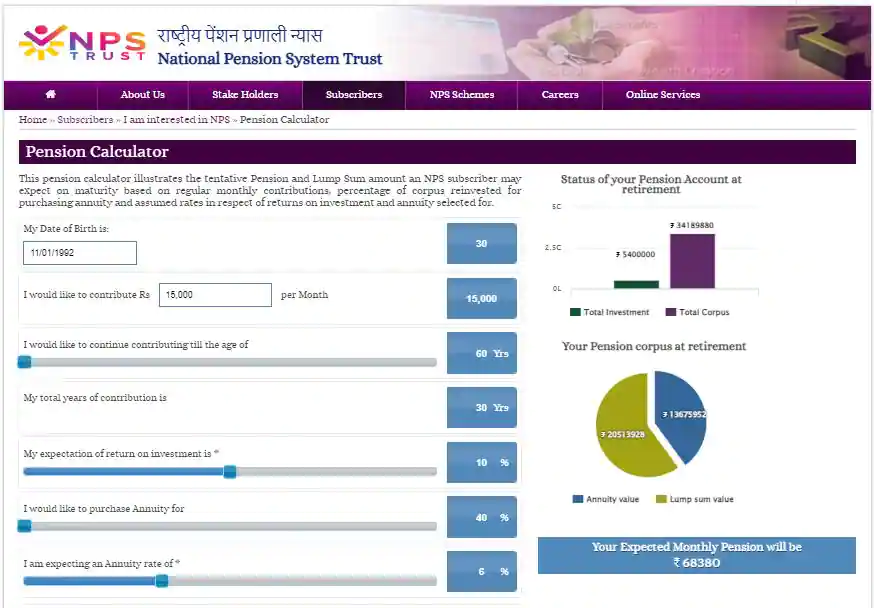

Pension calculator

On how to get maximum pension using NPS scheme, Pankaj Mathpal, MD & CEO at Optima Money Managers said, “In NPS scheme, it is mandator for an investor to buy annuity using at least 40 per cent of the maturity amount. But, my suggestion for the NPS account holder is to invest the lump sum amount received after maturity of the NPS scheme in SWP (Systematic Withdrawal Plan) and get around 8 per cent return on it for the long term. This will help the NPS scheme beneficiary to maximise one’s NPS benefits to a larger extent.”

On how SWP may change one’s monthly pension, Pankaj Mathpal said, “If a person invests ₹15,000 per month in NPS scheme, keeping debt-equity exposure in 40:60 ratio. Then after investing for 30 years, one would get a monthly pension of around ₹68,380 and around ₹2.05 crore lump sum amount as maturity. If the person invests this ₹2.05 crore lump sum amount in SWP for 25 years, then expecting at least 8 per cent return on one’s SWP amount of ₹2.05 crore, one would be able to get around ₹1.55 lakh per month. Adding NPS pension of ₹68,000 and this ₹1.55 lakh monthly SWP, one’s net monthly pension would fall around ₹2.23 lakh ( ₹68,000 + ₹1,55,000).

On SWP plans that one can look at Pankaj Mathpal listed out the following SWP plans:

1] ICICI Prudential Balanced Advantage Fund;

2] Aditya Birla Sunlife Balanced Advantage Fund; and

3] Canara Robeco Equity Hybrid Fund.