Income Tax Slab: At present, ITR has to be filed in the country according to the new tax regime and old tax regime. There are different tax slabs in both the tax regimes. At the same time, a lot of tax relief was also provided to the people in the new tax regime.

Income Tax: The process of filing income tax return has started. People are continuously filing their income tax returns. For those people whose income is taxable, it becomes very important to file income tax. At the same time, many changes have also been made regarding income tax from this financial year, the effect of which is going to be visible on the people. At the same time, a lot of relief has also been given by the government to the general public in the matter of tax.

Income Tax

At present, ITR has to be filed in the country according to the New Tax Regime and Old Tax Regime. There are different tax slabs in both the tax regimes. At the same time, a lot of tax relief was also provided to the people in the new tax regime. People are also going to get a lot of benefit from this. People have been given exemption from the government in tax filing.

Income tax exemption

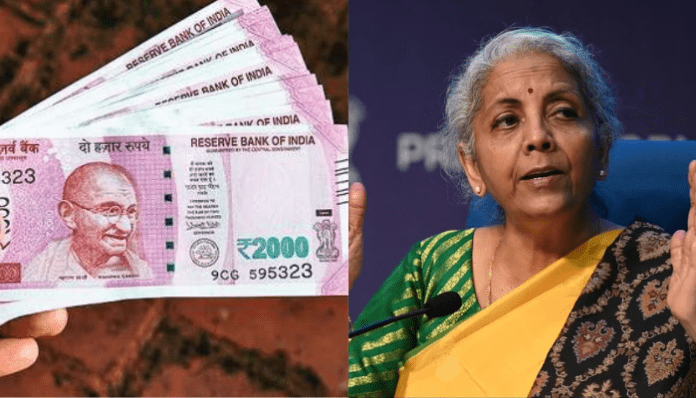

In fact, while presenting Budget 2023, it was announced by Finance Minister Nirmala Sitharaman that if a person’s annual income is up to Rs 7 lakh, then he will not have to pay tax on filing income tax under the new tax regime, that is, his tax Will get discount. Also, under the new tax regime, now there will be zero tax on income up to Rs 3 lakh annually.

New tax regime

- 0 tax on income up to Rs 3 lakh per annum

- 5% tax on income up to Rs 3-6 lakh per annum

- 10% tax on income up to Rs 6-9 lakh per annum

- 15% tax on income up to Rs 9-12 lakh annually

- 20 tax on income up to Rs 12-15 lakh annually

- 30% tax on income above Rs 15 lakh per annum

Old tax regime

Apart from this, if a person files income tax return under the old tax regime, then no changes have been made there. People will have to pay zero tax on annual income of Rs 2.5 lakh. At the same time, people will get tax exemption up to an annual income of Rs 5 lakh.