Karthik Srinivasan, Senior Vice President and Group Head (Financial Sector Ratings), Icra Limited, also expressed hope that the MPC will keep the policy rate steady. He said, “The tightness in cash seen in the second fortnight of September is unlikely to continue.

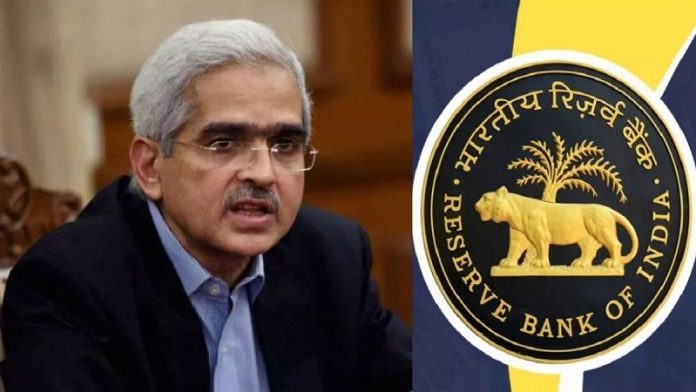

RBI can provide relief to all the loan takers including home, car loan during the festive season. In fact, the Reserve Bank of India (RBI) may keep the key policy rate repo unchanged at 6.5 percent in the monetary policy review to be presented at the end of next week. This means interest rates for retail and corporate borrowers may remain stable. Experts have expressed this opinion. In view of the Russia-Ukraine war, the Reserve Bank started increasing the policy rate in May 2022 and it reached 6.5 percent in February this year. Since then, the policy rate has been kept stable in the last three consecutive bi-monthly monetary policy review meetings.

Policy will be announced on October 6

The three-day meeting of the six-member Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, will begin on October 4. The results of the meeting will be announced on Friday (October 6). Madan Sabnavis, Chief Economist of Bank of Baroda, said, “This time the monetary policy is likely to continue with the existing rate structure as well as the policy stance. Therefore, the repo rate will be maintained at 6.5 percent. He said that retail inflation is still at a high level of 6.8 percent and it is expected to come down in September and October, but there are some apprehensions regarding Kharif production, which may increase the prices. Are. Karthik Srinivasan, Senior Vice President and Group Head (Financial Sector Ratings), Icra Limited, also expressed hope that the MPC will keep the policy rate steady. He said, “The tightness in cash seen in the second fortnight of September is unlikely to continue. Especially the incremental CRR implemented in the last policy review will release cash.

RBI’s liberal stance expected to continue

Rajan Bandelkar, national president of NAREDCO, said the RBI’s accommodative stance is expected to continue. RBI has kept the policy rates stable for a long time, which has benefited the sector. Nevertheless, in view of the ongoing festive season, there is a need to pay special attention to the real estate sector. A positive step by RBI at this time can play an important role in achieving our housing targets. Given the strong demand in the real estate sector in the country, it is imperative that we maintain low interest rates. This approach can effectively encourage potential buyers to take out loans to purchase property, resulting in a boost to overall real estate market activity. We anticipate that the RBI will ensure adequate liquidity within the banking system, as this is important to enable banks to provide lending and financing options to both developers and buyers.

Now consider reducing the repo rate

Vikas Garg, joint managing director, Ganga Realty, said, we are hopeful that the RBI will continue its industry-friendly stance and maintain the status quo on the repo rate. However, I would also like to say that reducing the repo rate should be considered. This will be a significant effort in encouraging first-time home buyers to invest in the property market as well as in reducing depressions such as high property loan interest rates. Due to increased demand in the real estate sector, the sector seems to be largely unaffected so far. Overall, we would welcome a commendable institutional intervention in steering the investment landscape.