Let us tell you, the maximum penalty of Rs 5 crore has been imposed on Citibank for not following the norms related to Depositor Education and Awareness Fund Scheme, Code of Conduct on Outsourcing of Financial Services.

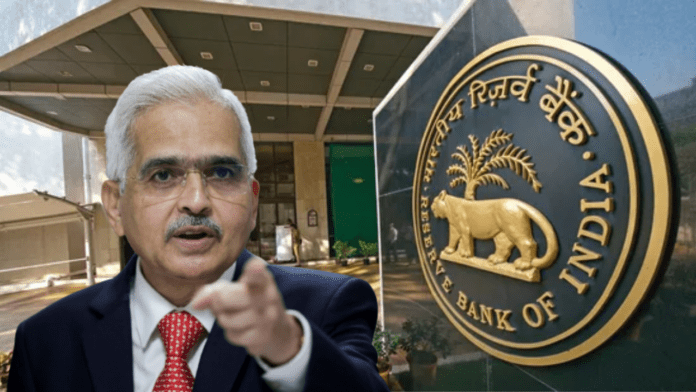

The Reserve Bank of India has imposed a total fine of Rs 10.34 crore on Citi Bank, Bank of Baroda and Indian Overseas Bank for violation of various regulatory norms. A maximum penalty of Rs 5 crore has been imposed on Citibank for non-compliance with norms related to Depositor Education and Awareness Fund Scheme and code of conduct on outsourcing of financial services, the Reserve Bank said in a statement.

Fine on Bank of Baroda also: At the same time, a fine of Rs 4.34 crore was imposed on the public sector Bank of Baroda for violation of some instructions related to the formation of ‘Central Repository’ regarding loans and other matters. Apart from this, a fine of Rs 1 crore was imposed on Chennai-based public sector Indian Overseas Bank for violation of loan related instructions. Regarding all three cases, the Reserve Bank said that the penalty is based on deficiencies in regulatory compliance. It is not intended to affect the validity of any transaction or agreement entered into by banks with their customers.

Board of Directors of Abhyudaya Cooperative Bank removed

The Reserve Bank suspended the board of directors of Abhyudaya Sahakari Bank for one year due to poor governance standards. Along with this, the Central Bank has appointed an administrator for the management of the co-operative bank. Former Chief General Manager of State Bank of India Satya Prakash Pathak has been appointed administrator of the Mumbai-based bank for one year, the Reserve Bank said.

Along with this, a committee of advisors has also been appointed to assist the Administrator. The Reserve Bank has not imposed any business restrictions on Abhyudaya Cooperative Bank and it will continue its normal banking activities under the guidance of the Bank Administrator.