LIC launched SIIP plan in March 2020. Then the value of NAV was 10 and now it is 16.43 i.e. there has been a growth of 64.3 percent from the beginning till now.

LIC SIIP: Nowadays every person wants better returns on investment. For this, people prefer to invest money in mutual funds and stock markets instead of traditional savings plans. If you also want to earn better returns in future by investing money in equity market related schemes, then you can invest in LIC’s SIIP. The special thing is that in this scheme, money has to be deposited in installments and there is a possibility of getting almost double the return on maturity.

Actually SIIP i.e. Systematic Investment Insurance Plan, is a unit linked insurance plan, in which the returns received are subject to market risks. At the same time, along with investment, insurance protection is also available in it. Let us know the features related to this scheme.

Both insurance and investment

SIIP is a unit-linked insurance plan that offers the benefits of both mutual funds and life insurance. Unit Link Insurance Plans are those plans in which the company invests the amount in equity, government bonds and securities.

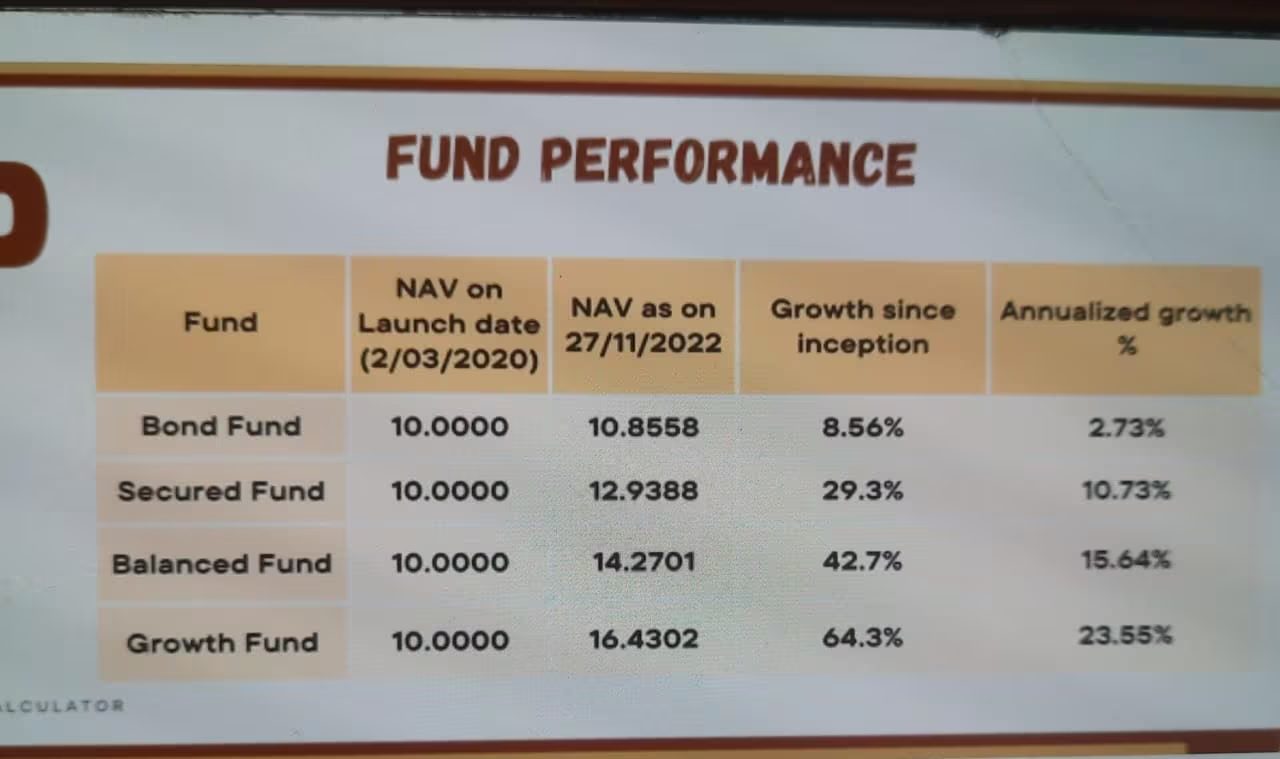

Policyholders get four different fund options to invest in LIC’s SIIP plan. These include bond funds, balanced funds, secured funds and growth funds. All these funds also have their own risks associated with them. However, the policyholder can change one fund after choosing it. Among these, the highest returns are obtained in growth funds, because under this fund up to 80 percent of the amount is invested in the stock market, where the possibility of returns is higher. However, market risk is also associated with it.

How will the money double?

This plan is available for different tenures of 10, 15, 20 and 25 years. Suppose, if you take SIIP plan for a period of 10 years and opt for growth fund. Under the scheme, if you deposit Rs 100,000 every year, then a total of Rs 10,00000 will be deposited in 10 years. On maturity, you will get a total of Rs 19.3 lakh considering NAV growth of 15 percent. However, this is a probable calculation.

LIC launched SIIP plan in March 2020. Then the value of NAV was 10 and now it is 16.43 i.e. there has been a growth of 64.3 percent from the beginning till now. At the same time, this return on annual basis was 23.55 percent. Actually, in ULIP plan, NAV i.e. Net Asset Value is given to the policyholder. As the value of NAV increases, the return is calculated based on the total NAV available with you.

- To take LIC SIIP policy, the policyholder’s age should be at least 90 days i.e. 3 months and maximum age should be 65 years.

- SIIP has two optional benefits namely Accidental Death Benefit Rider Option and Partial Withdrawal Facility.

- Tax exemption in this scheme will be available under Section 80C of the Income Tax Act, as well as the return received on maturity under Section 10 (10D) will be tax free.