Sukanya Samriddhi Yojana: After the government reviewed the interest rates on small savings schemes, there is a great news on Sukanya Samriddhi Yojana to secure the future of daughters. Just before the Lok Sabha elections 2024, the Central Government has increased the interest rates of Sukanya Samriddhi Yojana by 0.20%. Now this scheme will get 8.2% interest for the January-March quarter, which was earlier 8%.

This increase will definitely excite the parents of daughters, and encourage them to invest for a better future of their daughters. Let us know what effect this new interest rate will have on your investment and also know about other attractive benefits of Sukanya Samriddhi Yojana.

Impact of increase:

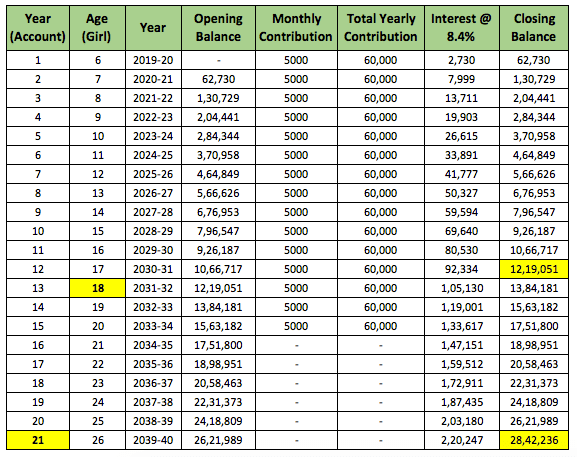

Suppose you deposit a maximum of Rs 1.5 lakh in SSY account every year. With 8% interest rate, you would have got a maturity amount of around Rs 34.43 lakh in a tenure of 15 years. But now, with the new 8.2% interest rate, you can get around Rs 35.78 lakh. This is an additional benefit of Rs 1.35 lakh, which will definitely come in handy for expenses like your daughter’s higher education or marriage.

Other benefits of Sukanya Samriddhi Yojana:

Government Guarantee: Sukanya Samriddhi Yojna is a government scheme, which means your investments are safe and you get guaranteed returns.

Tax Benefits: Under Section 80C of the Income Tax Act, you can claim tax benefits on investments up to Rs 1.50 lakh deposited in Sukanya Samriddhi Yojana account in a financial year.

Tax Free Interest: The interest earned in Sukanya Samriddhi Yojana account is completely tax free.

Flexibility: You can open a Sukanya Samriddhi Yojana account by depositing a minimum of Rs 250 in any post office or bank. The maximum investment annually is Rs 1.5 lakh.

Partial Withdrawal: Once your daughter turns 18, you can make a partial withdrawal from the account. Up to 50% of the total balance can be withdrawn in a financial year.

Full Maturity: After 21 years from account opening or when your daughter turns 21, whichever is later, the account matures and the entire amount along with interest is received.

Other interest rate changes on small savings schemes:

Apart from Sukanya Samriddhi Yojana, the government has also increased the interest rates on three-year fixed deposit scheme by 0.10%. However, the interest rates of all other small savings schemes have been kept unchanged.

Sukanya Samriddhi Yojana The increase in interest rates is a positive step which will not only encourage the parents of daughters but will also play an important role in securing the future of the daughters. It will provide financial assistance for the education, health and other needs of the daughters. If you want to invest in your daughter’s future, Sukanya Samriddhi Yojana is definitely an excellent option worth considering.