NBFC in Trouble: RBI said that due to various reasons, 9 NBFCs and one housing company have surrendered their licenses.

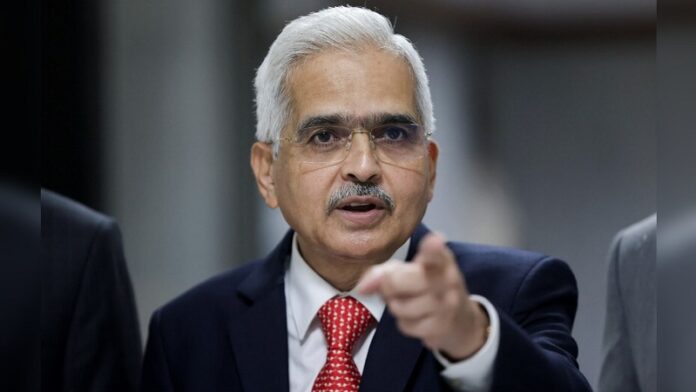

NBFC in Trouble: Reserve Bank of India (RBI) is in the mood for strict action these days. First, the license of Paytm Payments Bank was canceled and then the functioning of a cooperative bank of Maharashtra was banned. Now on Saturday, RBI has canceled the registration certificates of three NBFCs. Bharathu Investment and Finance India, Cox & Kings Financial Services and PSPR Enterprises have been hit by RBI’s strictness. Along with this, 9 NBFCs and housing companies have surrendered their licenses.

These NBFCs and housing companies surrendered their licenses.

The Reserve Bank has informed that 9 NBFCs and one housing finance company have surrendered their licenses. Reliance Home Finance Limited is also included in these. The company has decided to return the license after exiting the housing finance institution business. Among the nine NBFCs that have surrendered their licenses, Smile Microfinance, JFC Impex, Kaveri Tradefin and Ginni Tradefin have gone out of business. Apart from this, JG Trading and Investment, SK Finserv, Microfirm Capital, Bohra & Company and Mahico Grow Finance Private Limited surrendered their licenses. All these companies have given different reasons.

Number of NBFCs reduced from 200 to 26

According to RBI, the rules were not being followed properly in these NBFCs. This cannot be tolerated. The central bank said that NBFCs are formed to fulfill certain economic objectives. It is unnatural for them to demand to become like banks. RBI is not in favor of allowing more number of NBFCs to accept deposits. This is the reason why not a single new license has been given. Also, the number of NBFCs accepting deposits has reduced from 200 to only 26.

Regulatory changes coming in the financial sector

These decisions of RBI clearly show that regulatory changes are coming in the financial sector. RBI is in no mood to tolerate the loophole. This is the reason why many companies have surrendered their licenses. These steps of the central bank are to follow the regulatory rules responsibly and keep the financial system healthy and stable by making finance companies accountable.