Bank License Canceled: The Reserve Bank of India (RBI) said that as per the bank’s data, 99.13 per cent of depositors are entitled to receive the full amount of their deposits from DICGC.

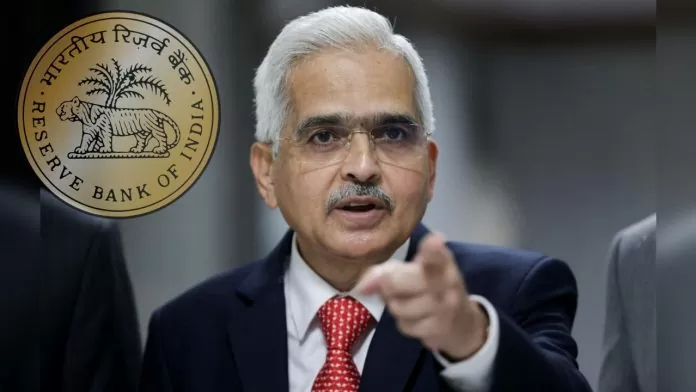

Bank License Canceled: Reserve Bank of India is keeping a strict watch on the banks these days. If RBI investigates any banks and during this time any flaw related to violation of rules is found, then fines, cancellation of banking license and even ban are imposed on them. After recently banning Paytm Payments Bank, this time RBI has taken action on Sumerpur Mercantile Urban Co-operative Bank.

License of Sumerpur Mercantile Urban Co-operative Bank canceled

The Reserve Bank on Wednesday canceled the license of Sumerpur Mercantile Urban Cooperative Bank located in Pali, Rajasthan. The reason for this is that this bank does not have sufficient capital and earning potential.

In a statement, the Reserve Bank of India (RBI) said that the Registrar of Co-operative Societies, Rajasthan has also been requested to issue an order to close the bank and appoint a liquidator. According to this, on liquidation, every depositor will be entitled to receive a deposit insurance claim amount of up to Rs 5 lakh of his deposits from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Bank does not have enough capital and earning potential: RBI

The Reserve Bank (RBI) said, “As per the bank’s data, 99.13 percent depositors are entitled to receive the full amount of their deposits from DICGC. Giving the reason for canceling the license, RBI said that Sumerpur Mercantile Urban Cooperative Bank does not have sufficient capital and earning potential.

Reserve Bank bans Paytm Payments Bank

Last month, the Reserve Bank took major action against Paytm Payments Bank Limited (RBI Ban On Paytm Payments Bank). RBI issued an order on January 31 banning Paytm Payments Bank Limited from opening any customer account after February 29. , asked to stop further deposits, transactions or top-up in prepaid instruments, wallets, Fastag and National Common Mobility Cards. The Central Bank has now extended its deadline to March 15.