MCLR Hike: The government bank has increased the Margin Cost of Funds Based Lending Rates (MCLR) by 0.05 percent i.e. 5 basis points. The new rates will be applicable from March 12, 2024.

MCLR Hike: Public sector Canara Bank has given a big shock to crores of customers. Government bank Canara Bank has increased the Margin Cost of Funds Based Lending Rates (MCLR) by 0.05 percent i.e. 5 basis points. According to the information given to the stock market, the new rates will be applicable from March 12, 2024. Let us tell you that due to increase in MCLR, interest rates on home loan, car loan and personal loan also increase.

What is MCLR?

MCLR i.e. Marginal Cost of Funds Based Lending Rates is the rate on the basis of which banks give loans to customers. Changes in this have a direct impact on the EMI of the customers. The bank cannot offer loan at a rate lower than MCLR. Increase in MCLR will increase the loan rates linked to it.

New loan rates

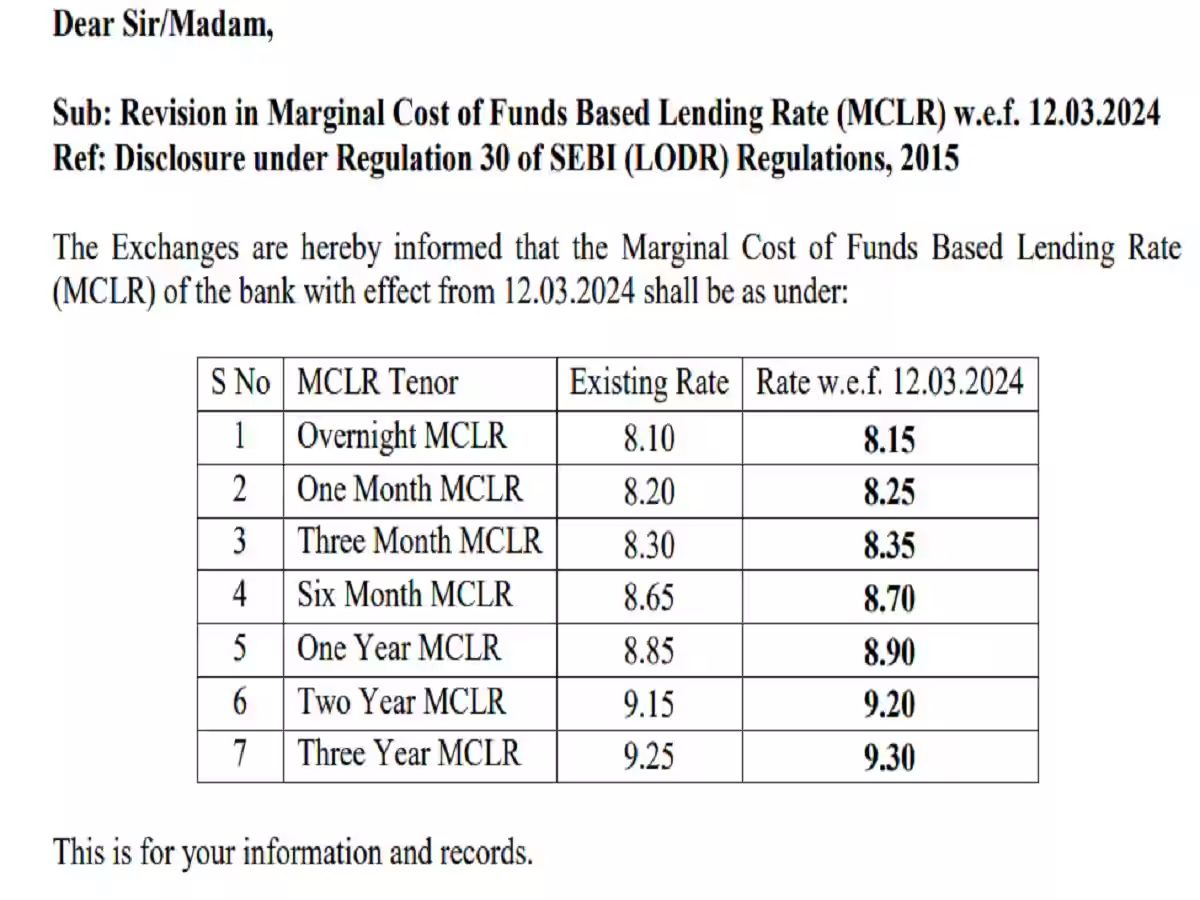

According to the information available on BSE website, Canara Bank’s overnight MCLR has been increased from 8.10% to 8.15%. Whereas one month MCLR has been increased from 8.20% to 8.25%. 3 month MCLR has increased from 8.30% to 8.35% and 6 month MCLR has increased from 8.65% to 8.7%.

At the same time, MCLR for 1 year has also increased by 0.05 percent. Now 1 year MCLR has increased from 8.85% to 8.90%. Whereas 2 year MCLR has increased from 9.15% to 9.20% and 3 year MCLR has increased from 9.25% to 9.3%. The new rates will be applicable from Tuesday.