You will get the option of FD in both banks and post offices, but you will get the option of NSC in the post office. Know which one is more beneficial for you to invest in.

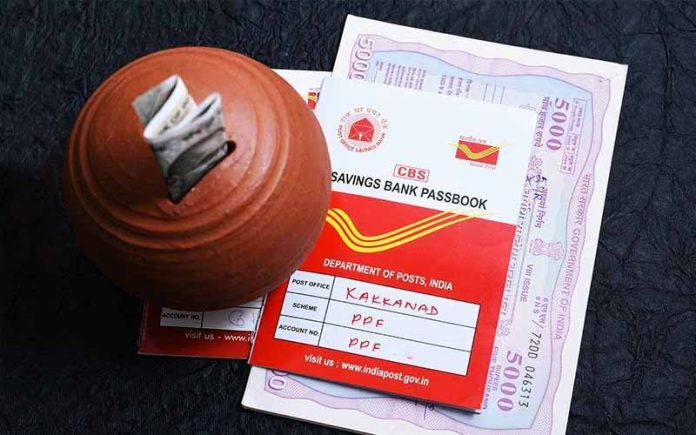

Post Office Schemes: Fixed deposits are considered very good in terms of safe investment. FD is a good option for those who do not like to take any kind of risk in investment. One good thing about FD is that you can choose the tenure from 7 days to 10 years as per your convenience. But if you are thinking of getting a 5-year FD for 5 years, then you can also choose the option of National Savings Certificate.

You will get the option of FD at both banks and post offices, but you will get the option of NSC at the post office. At present, interest is being given at the rate of 7.7 percent in 5 year NSC. Besides, you will also get tax benefits.

How much return on post office FD

If you get FD done in the post office, then you will get interest at the rate of 6.9% on one year FD, 7.0% on two year FD, 7.1% on three year FD and 7.5% on 5 year FD. If calculated according to FD calculator, then on investment of Rs 1 lakh, the maturity amount will be Rs 1,07,081 in one year at 6.9% interest, Rs 1,14,888 in two years at 7% interest, at 7.1% interest. You will get Rs 1,23,508 in three years and Rs 1,44,995 in 5 years at 7.5 percent interest. Let us tell you that tax benefits are also available on five year FD.

How much return on NSC

If you invest in NSC instead of post office FD, then you will get interest at the rate of 7.7 percent. By investing Rs 1 lakh in NSC, you will get only Rs 44,903 as interest at the rate of 7.7 percent interest. In this way, a total of Rs 1,44,903 will be received in the maturity period. Tax benefits are available in NSC under 80C.

Who can invest in NSC

Anyone can open an NSC account. NSC can be purchased in the name of the child on behalf of his/her parents or guardian, whereas a child above 10 years of age can also buy NSC in his/her own name. Two to three people can also open a joint account. Minimum investment of Rs 1000 has to be made in NSC. After that you can buy certificates in multiples of 100. There is no limit to invest in this.