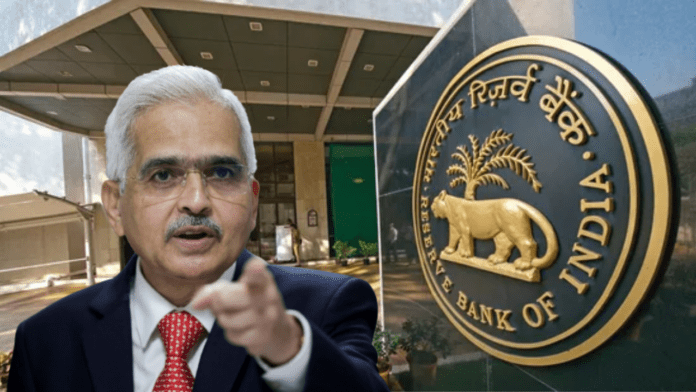

The Reserve Bank of India (RBI) has imposed a fine of Rs 1 crore on IDFC First Bank and Rs 49.70 lakh on LIC Housing Finance for violation of certain rules.

New Delhi. The Reserve Bank of India (RBI) keeps an eye on the functioning of all the banks or NBFCs in the country. Whenever a bank ignores RBI rules and does its own thing, the central bank can impose a fine on it. In this series, the Reserve Bank of India has imposed a fine of Rs 1 crore on IDFC First Bank and Rs 49.70 lakh on LIC Housing Finance for violation of some rules.

The RBI said in a statement on Friday that the penalty has been imposed on IDFC First Bank for non-compliance with certain directions on ‘Loans and Advances – Statutory and Other Restrictions’. RBI said in another statement that the penalty on LIC Housing Finance has been imposed for non-compliance with some provisions of the ‘Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Guidelines, 2021’ issued by RBI.

Will customers be affected?

In both cases, the penalty has been imposed for deficiencies in regulatory compliance. It is not intended to affect the validity of any transaction or agreement with the respective customers.

RBI cancels certificates of registration of 4 NBFCs

Meanwhile, RBI has canceled the Certificate of Registration (CoR) of 4 non-banking finance companies (NBFC) Kundals Motor Finance, Nitya Finance, Bhatia Higher Purchase and Jeevanjyoti Deposits and Advances. After this these companies can no longer do NBFC business.

5 NBFCs returned certificates of registration

At the same time, 5 other NBFCs – Growing Opportunity Finance (India), Invel Commercial, Mohan Finance, Saraswati Properties and Quikr Marketing have returned their certificates of registration.