PAN-Aadhaar Linking Update: CBDT was receiving complaints that the deductee-collectee had died before the last date for linking PAN-Aadhaar i.e. 31st May 2024, due to which they could not link PAN-Aadhaar.

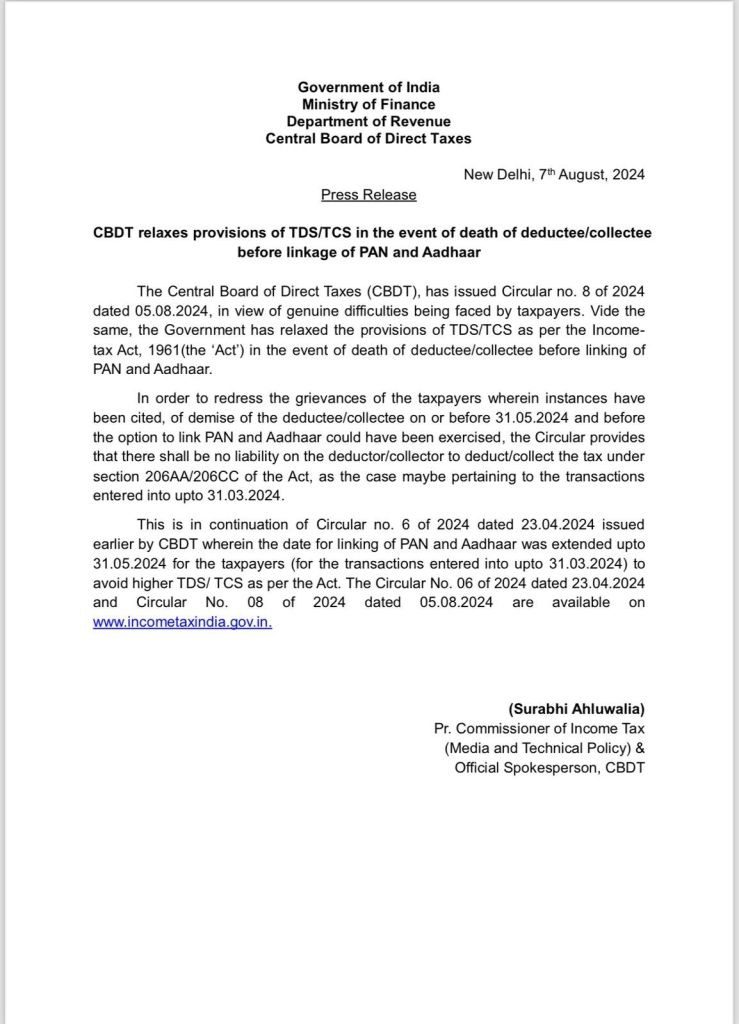

PAN-Aadhaar Linking: The Central Board of Direct Taxes (CBDT) has issued a circular giving major relief regarding the provisions of TDS and TCS in the event of the death of the deductee and collector before linking PAN and Aadhaar before 31 May 2024.

The Finance Ministry said that in view of the problems being faced by the taxpayers, the Central Board of Direct Taxes has issued a circular on 5 August 2024 in which the government has given relief in the provisions of TDS and TCS in the Income Tax Act 1961 in case of death of the deductee and collector before linking PAN and Aadhaar. In such cases where the deductee and collector have died before May 31, 2024 and before exercising the option of linking PAN with Aadhaar, in order to redress the grievances of taxpayers, as per the circular, the deductor and collector will not have any liability to deduct tax under section 206AA/206CC of the Income Tax Act in respect of transactions made up to March 31, 2024.

The Finance Ministry said, on 23 April 2024, the Central Board of Direct Taxes had issued a circular to provide relief from higher TDS (TCS) under the Income Tax Act on transactions made till 31 March 2024, and this is a continuation of the same circular which extended the deadline to 31 May 2024 for linking PAN and Aadhaar.

CBDT was receiving complaints from taxpayers that the deductee-collectee had died before the last date of 31 May 2024 for linking PAN-Aadhaar, due to which they could not link PAN-Aadhaar. In such a situation, the request for tax demand is pending. According to the rules, if the taxpayer fails to link PAN Aadhaar, 20 per cent TDS is deducted, which is the rule of deducting 5 per cent TCS. To avoid higher TDS TCS, the government had extended the date for linking PAN-Aadhaar to 31 May 2024.