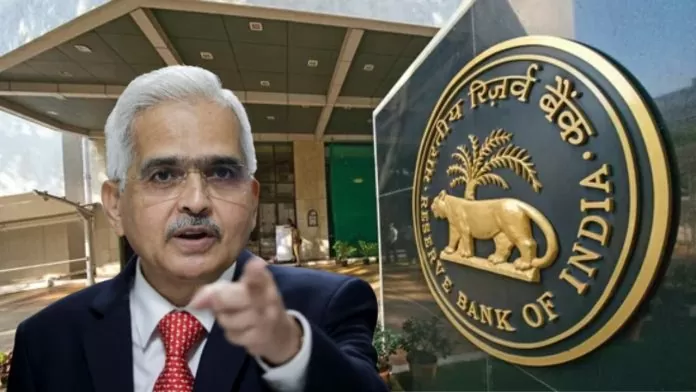

RBI has imposed monetary fine on two banks. The banks have violated the rules.

RBI Action: The Reserve Bank of India has taken strict action against two banks. Both these banks are located in different states of India. They are accused of violating banking related rules. RBI has given this information on Monday, November 4.

Sahyog Urban Co-operative Bank Limited, Udgir, Maharashtra has been fined Rs 1.5 lakh. At the same time, Tura Urban Co-operative Bank Limited, Tura, Meghalaya has been imposed a monetary penalty of one lakh rupees. RBI has taken this action under sections 46 (4) (i), 56 and 47 A (1) (C) of the Banking Regulation Act 1949.

How much penalty was imposed on which bank? (RBI Monetary Penalty)

Sahyog Urban Co-operative Bank Limited failed to transfer the letter amount to the Depositor Education and Awareness Fund within the stipulated time. Tura Urban Co-operative Bank Limited did not follow the instructions issued under SAF and made capital expenditure of more than 25,000 per annum without prior approval of RBI. Also, new loans were sanctioned in excess of the risk limit prescribed under SAF.

What will be the impact on customers? (Reserve Bank of India)

This was revealed during the statutory inspection. After which notices were issued to the banks. RBI decided to impose monetary penalty on both the banks only after considering the reply received on the notice and the oral presentation during the personal hearing. However, this action is based on the flaws in the rules. It will not affect the transactions or agreements between customers and banks.