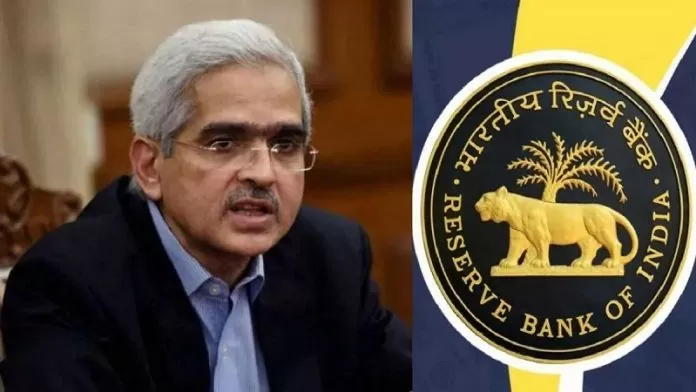

Five banks have violated the rules. RBI has also issued an order to impose monetary penalty on them. Let us know why the central bank took this step?

RBI Action: The Reserve Bank of India has imposed a heavy monetary penalty on 5 cooperative banks for violating the rules. RBI has also issued an order for action. Two banks included in this list are located in Karnataka. The banks are located in Bengaluru, Tamil Nadu and Kerala.

RBI has taken action against Sri Charan Souharda Co-operative Bank Limited (Bengaluru), Sri Ranganam Co-operative Urban Bank Limited (Tamil Nadu), The Nilambur Co-operative Urban Bank Limited (Kerala), Manavi Pattana Souharda Sahakari Bank Niyamitha (Karnataka) and Sri Mahabaleshwar Co-operative Bank Limited (Karnataka). Some of these banks have violated the rules related to SAS and some have violated the rules related to loans.

RBI issued show cause notice (Reserve Bank of India)

During the inspection, RBI found flaws in compliance with the rules. After which show cause notices were issued to all the banks. The central bank asked “Why should they not be fined even after not complying with the rules?” The decision to impose monetary penalty was taken only after the reply received on the notice and investigation.

Banks violated these rules (RBI Monetary Penalty)

- Shri Charan Saudhar Co-operative Bank Limited has been fined Rs 2 lakh. The bank failed to classify some loan accounts as non-performing assets in terms of income recognition asset classification and provisioning norms. Offered interest on deposits at interest rates higher than the interest rates offered by SBI. Approved new loans and advances without following the instructions issued under SAF.

- RBI has imposed a fine of Rs 1,50,000 on Shri Ranganam Co-operative Urban Bank Limited. The bank sanctioned loans to the relatives of the directors. Also approved new loans and advances with risky more than 100% and loan facilities to areas with high ratio of non-performing assets without following SAF instructions.

- The Nilambur Co-operative Urban Bank Limited has been fined Rs 50000. The bank made donations without following the instructions issued under SAF.

- Manavi Pattana Saudhar Sahakari Bank Niyamitha has been fined Rs 25,000. The bank did not comply with the directions issued under SAF and sanctioned loans and advances at interest rates higher than those charged by SBI.

- Shri Mahabaleshwar Urban Co-operative Bank Ltd has been fined Rs 5 lakh. The bank sanctioned several loans and advances to relatives of directors.