People think that when they open a bank account, they get an ATM card for free, but that is not true. Let us know what types of charges are levied on SBI ATM cards.

ATM card charge: Many people use the ATM-cum-Debit Card of State Bank of India. However, very few people know about the various charges levied on it. People think that when they open a bank account, they get an ATM card for free, but it is not so. Let us know what types of charges are levied on SBI ATM card.

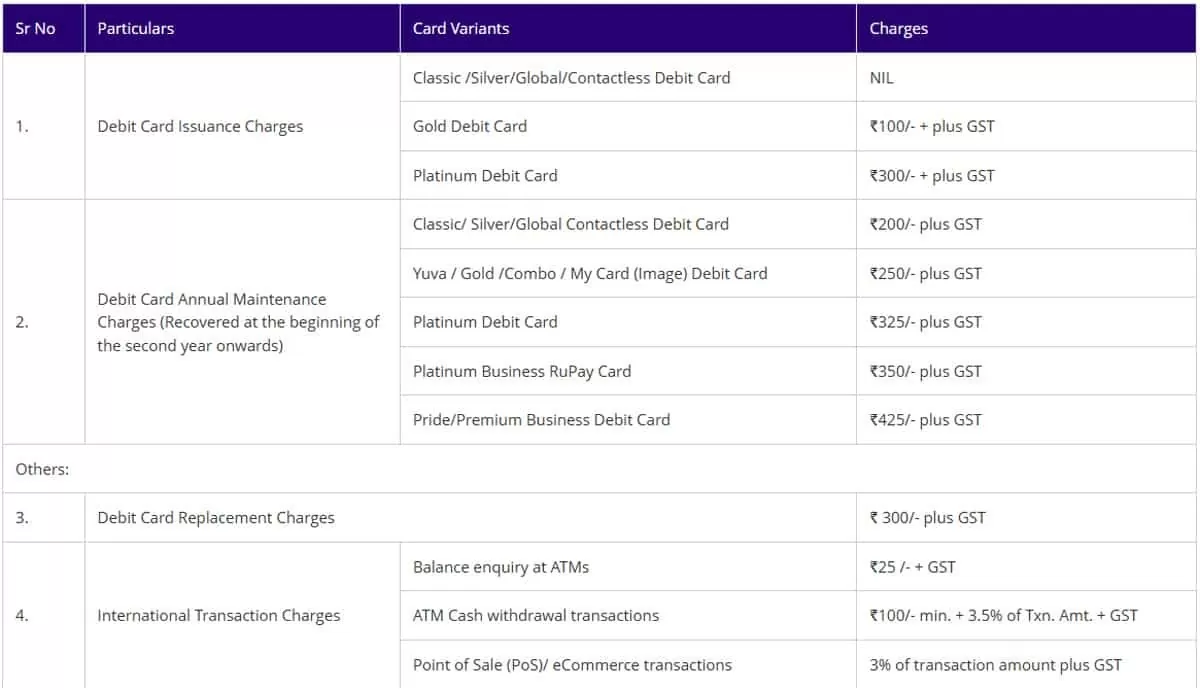

1- Charge for issuing debit card

According to the website of State Bank of India, there are three categories of charges for issuing debit card.

Classic /Silver/Global/Contactless Debit Card – There is no charge on this.

Gold Debit Card- Rs.100+GST

Platinum Debit Card- Rs.300+GST

2- Annual Charge on Debit Card

All ATM cards i.e. debit cards also have an annual charge, which most banks call annual maintenance charge. This charge starts from the second year after opening the account. This charge is different on different types of cards.

Classic/Silver/Global Contactless Debit Card- Rs 200+GST

Yuva/Gold/Combo/My Card Debit Card- Rs 250+GST

Platinum Debit Card- Rs 325+GST

Platinum Business RuPay Card- Rs 350+GST

Pride/Premium Business Debit Card- Rs 425+GST

3- Debit card replacement charge

If your card is lost or stolen and you get it replaced, then you have to pay a charge of Rs 300 + GST to the bank.

4- International transaction charge

This charge varies in different situations. If you just check the balance at the ATM, then you will have to pay Rs 25 + GST. On the other hand, if you withdraw cash from the ATM, then you have to pay at least Rs 100 per transaction + up to 3.5 percent of the transaction amount + GST. If you do an international transaction or an e-commerce transaction on a POS machine, then you have to pay a charge of 3 percent of the transaction amount + GST.