Common Cheque mistakes: Use of Cheque is common for transactions. Especially, Cheque are used extensively for payment of large amounts. But, do you know what mistakes people often make while filling cheques?

New Delhi. Cheque Book is used by most of the people who use banking facilities. A lot of transactions take place in our country through cheques. Cheque are used for any major payment or transaction. If you also frequently use Cheque for transactions, then you should fill the Cheque very carefully. Even a small mistake made by you can cause big problems. There are one or two mistakes due to which your bank account may become empty.

The bank pays the amount written on the Cheque to the person whose name we fill in the cheque. The name of the person to whom the money is to be given has to be written in the cheque. Apart from the individual, the Cheque can also be issued in the name of any company or institution. Some people often make some mistakes while filling cheques. Today we will tell you only about these commonly occurring mistakes.

Do not write only after amount

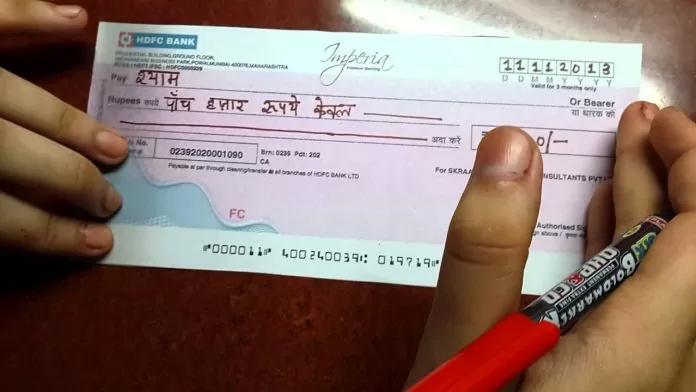

This is the mistake that many people make. Whenever you give a Cheque to someone, write ‘only’ at the end of the amount you have written in words. Like ‘Five lakhs only’. Similarly, at the end of the amount written in numbers, make sure to put an oblique symbol (/). Like, 500000/. Actually, the purpose of writing Only at the end of the amount on the Cheque is to prevent possible fraud. If you do not do this then it is possible that the Cheque taker may write something else before the amount and withdraw more amount from your account.

Signing a blank Cheque

Usually people trust and sign a blank cheque. You should never make such a mistake. Before signing the cheque, always write the name, amount and date of the person to whom the Cheque is being given.

Wrong signature

The reason why a large number of Cheque bounce in banks is due to wrong signature by the Cheque drawer. Even if the signature does not match the signature present in the bank, the Cheque will be bounced. Therefore, sign the Cheque in the same manner as you did on the bank form so that your signature matches the signature available in the bank and the bank clears the cheque.

Writing wrong date

Banks do not accept Cheque even if the date is wrong. Therefore, while drawing a cheque, write the date correctly on the Cheque so that there is no problem in encashing it.

Not using permanent ink in Cheque

While filling the cheque, also Cheque the quality of the ink of the PAN. Many people cut Cheque with a pen whose writing is faint or which can be easily erased and something else can be written on it. To avoid tampering with the cheque, permanent ink should be used so that it cannot be cut or changed later.

cutting a Cheque without sufficient account balance

If the Cheque bounces, you may have to go to jail along with fine. When a bank rejects a Cheque for some reason and payment is not made, it is called bounced cheque. The reason for this happening is mostly due to lack of balance in the account. It is very important to have sufficient balance in your account while issuing the cheque.

Issuance of post-dating Cheque

Avoid post-dating the Cheque as the bank may not accept it. The date plays an important role in paying the Cheque to the bank. You can enter the date when you want the funds to be deducted from your account. If you have entered the wrong date, month or year, your Cheque will most likely be returned.

Don’t remember Cheque number

Take note of the Cheque number and note it in your records. It is important to make sure you write it down in a safe place. Whenever there is any dispute, you can always use this Cheque number to clear doubts or to give it to the bank for verification.