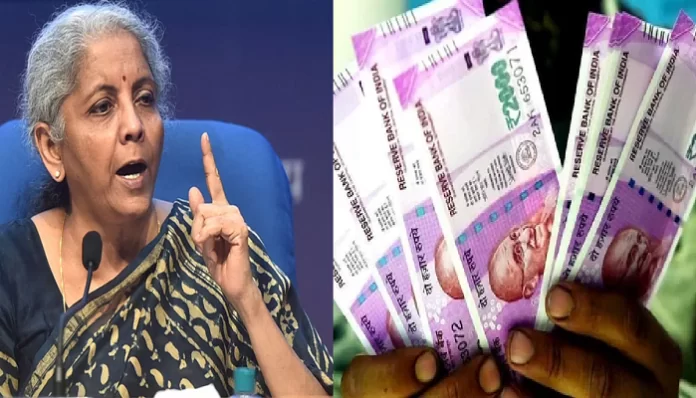

PPF-Sukanya Samriddhi Yojana Update: If you also have a plan to invest money in any small savings scheme, then this is important news for you. A notification has been issued by the Ministry of Finance, in which it has been told that who can invest in this government scheme now.

Small Savings Schemes Rules: If you have also invested money in any government scheme like Public Provident Fund (PPF), Senior Citizen Saving Scheme (SCSS), Sukanya Samriddhi Yojana (SSY), then this news is useful for you. The government has changed the rules for those investing in these schemes. Now if you are also planning to invest in any of these government schemes, then you will not be able to take advantage of it without PAN and Aadhaar card.

Finance Ministry had issued notification

Information about this was given by the Finance Ministry some time back by issuing a notification. It was told in this notification that Small Savings Schemes will be used as KYC.

Pan card will have to be shown

Apart from this, the Finance Ministry has said that investors will have to first submit the Aadhaar enrollment number to make any further investment. Apart from this, PAN card will have to be shown to invest more than the limit. You will not be able to invest without PAN card.

6 months time

If you do not have Aadhaar while opening an account for Post Office Savings Scheme, you will have to submit proof of enrollment slip for Aadhaar. Also, to link the investor with the investment of ‘Small Savings Scheme’, the Aadhaar number will have to be given within six months from the date of opening the account.

Let us tell you that from now on, what documents will you need to open an account in Small Savings Scheme-

- You should have Aadhaar number or Dhar enrollment slip

- Also passport size photograph should be there

- PAN number, if existing investors do not submit PAN card and Aadhaar card by 30 September 2023, then their account will be banned from 1 October 2023.