Small Savings Schemes Interest rate: The government has given good news on Friday to those investing in Small Savings Scheme. However, the government has not made any change in the interest rates of PPF (Public Provident Fund), NSC (National Savings Certificate), Kisan Vikas Patra (KVP), Senior Citizen Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY).

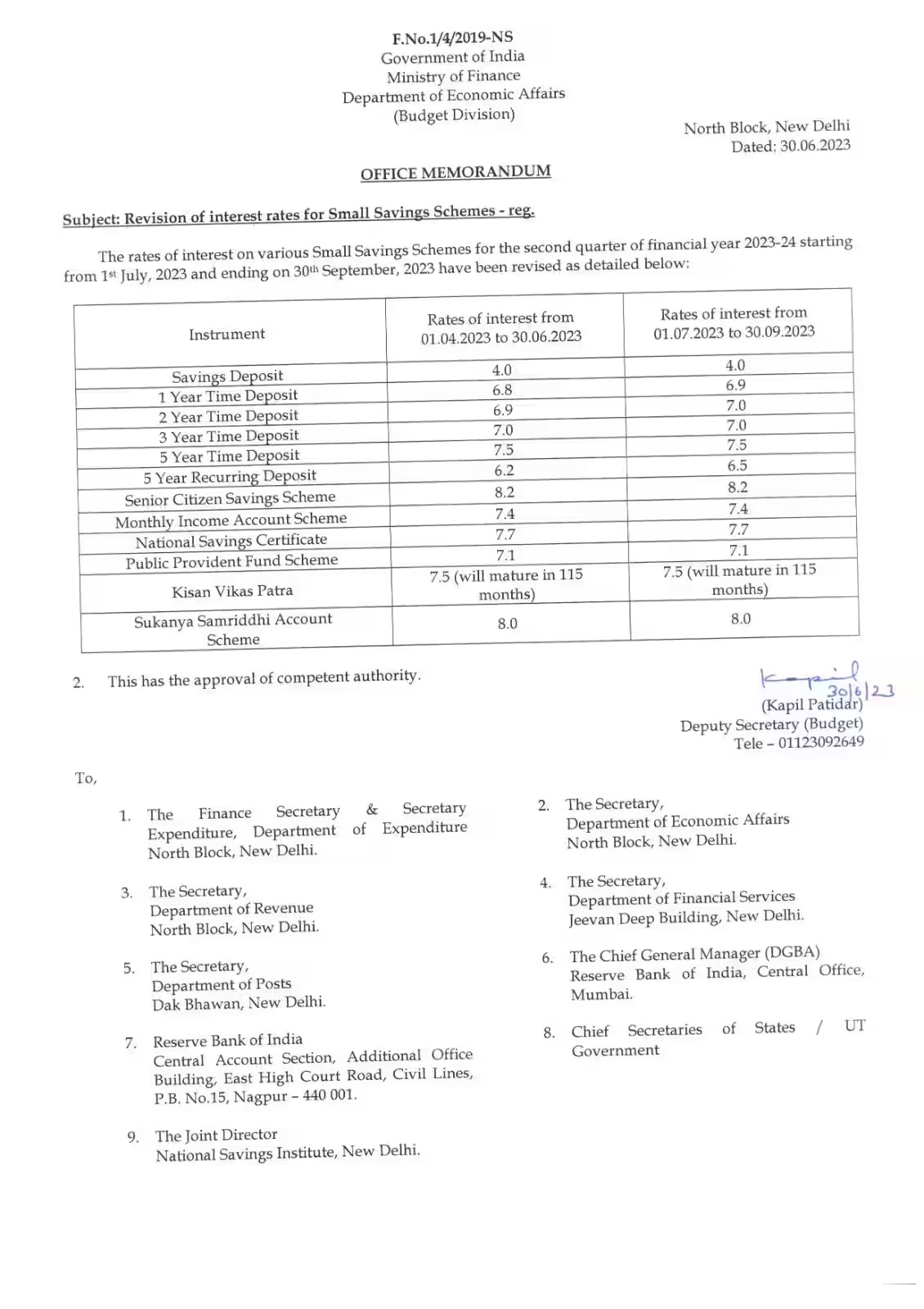

Small Savings Schemes Interest rate: The government has given good news on Friday to those investing in small savings schemes. The interest rates of Small Savings Schemes have been changed and the government has increased the interest rates for the second quarter. For July-September, the government has increased these small savings schemes by 10-30 bps.

This time the government has not made any change in the interest of PPF (Public Provident Fund), NSC (National Savings Certificate), Kisan Vikas Patra (KVP), Senior Citizen Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY).

What are Ownership Holders on Small Savings Mortgages?

Was this change last time?

For the first quarter of the current financial year i.e. April-June 2023, the interest rates of only one small savings scheme (Small Savings Schemes Interest rate) were changed. Then the government had increased the interest on 5-year National Savings Certificate (NSC) by 0.70 percent to 7.7 percent. This was the third consecutive quarter, when the interest of any of the small savings schemes has been increased. Prior to this change, the highest interest of up to 8.2 per cent was being received on Senior Citizen Savings Schemes (SCSS).