Bank Deposit Insurance Limit: Rating agency ICRA said that increasing the insurance limit on deposits in banks beyond ₹ 5 lakh will have a slight but significant impact on their profits.

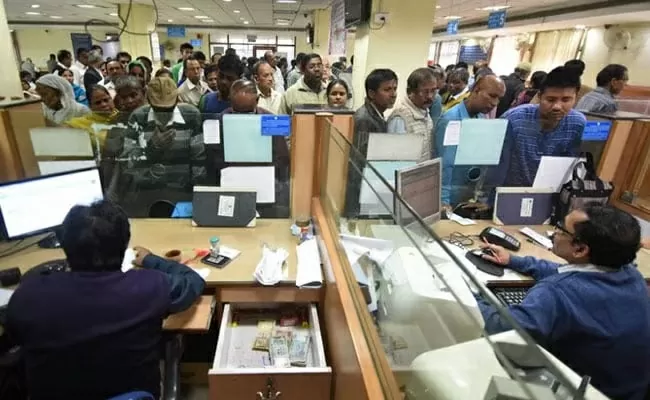

Bank Deposit Insurance Limit: Rating agency ICRA said that increasing the insurance limit on deposits in banks beyond ₹5 lakh will have a slight but significant impact on their profits. Currently, the amount deposited by a customer in a bank gets an insurance cover of up to ₹5 lakh, which is regulated by the Deposit Insurance and Credit Guarantee Corporation (DICGC). DICGC ensures the safety of customer deposits by charging premium from banks, so that in case of bankruptcy of a bank, the money of the customers is safe.

The government is considering increasing the deposit insurance limit

Department of Financial Services Secretary M. Nagaraju recently said that the government is actively considering increasing the deposit insurance limit beyond ₹5 lakh. He gave this information in a press conference held in the presence of Finance Minister Nirmala Sitharaman on February 17.

He said, “The issue of increasing the deposit insurance limit is under active consideration of the government. As soon as the government approves it, we will issue its official notification.”

Questions raised after New India Co-operative Bank scam

Nagaraju’s statement comes at a time when the New India Co-operative Bank scam has come to light recently, after which the RBI has imposed strict restrictions on the bank. These include a ban on issuing new loans, suspending withdrawal of deposits and dissolving the bank’s board.

ICRA said that the crisis of New India Co-operative Bank played an important role in bringing the issue under the consideration of the government. However, the agency also warned that if the deposit insurance limit is increased, the profitability of banks could be affected by up to ₹ 12,000 crore.

Possible impact on banking sector

ICRA’s Financial Sector Rating Head Sachin Sachdeva said, “The recent failure of New India Co-operative Bank has brought into focus the possible increase in deposit insurance limits. This will have a slight but significant impact on the profitability of banks.”

The agency reminded that the deposit insurance limit was increased from ₹ 1 lakh to ₹ 5 lakh after the PMC Bank crisis in February 2020. By March 2024, 97.8% of the country’s bank accounts were fully covered, as were deposits of less than ₹5 lakh. However, the insured deposit ratio (IDR) stood at 43.1% by March 2024.

Impact on banks’ profits

Since the increase in IDR will require banks to pay more premium, it will have a direct impact on their profits. ICRA said that if the IDR increases to 47-66.5%, the annual profit after tax (PAT) of banks can be affected by ₹1,800 crore to ₹12,000 crore.

Return on assets (RoA) of banks can decrease by 0.01-0.04%.

Return on equity (RoE) can decrease by 0.07-0.4%.

Decline in deposit insurance reserve ratio (RR)

Increase in insured deposits of banks will lead to a decline in the deposit insurance fund and insured deposit ratio (Reserve Ratio – RR). Currently it is 2.1%, but it can come down to 1.5-2.1%.