Bank of Baroda Hikes Interest Rates on Loan: RBI MPC has not made any change in the repo rate. In such a situation, there is relief on the repo rate linked loan. But Bank of Baroda (BoB) has increased the benchmark lending rates.

New Delhi: Millions of customers of Bank of Baroda (BoB) have got a big shock. Because, the bank has increased the interest rates of many tenure loans. Due to this decision of the bank, the existing loan holders will have to pay a higher amount of EMI, while new loan customers will get the amount at an expensive interest rate.

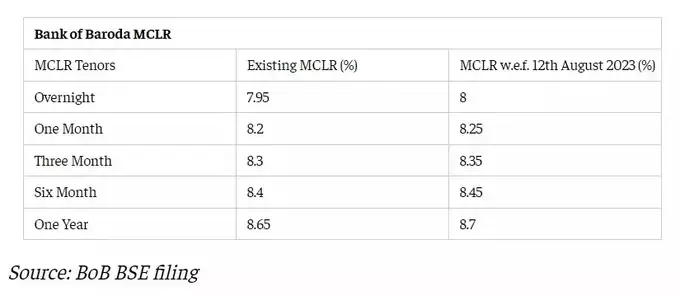

RBI MPC did not make any change in repo rate and announced status quo on rates. Generally, when the repo rate increases, then banks increase the cost rate on every loan, due to which the interest rates increase. But, despite no change in the repo rate, Bank of Baroda (BoB) has increased the benchmark lending rates by 5 bps on certain tenures. The bank has said that the new rates are being made effective from 12 August 2023.

Bank of Baroda New MCLR Rates

After the increase in the benchmark rates of Bank of Baroda (BoB), the fund based loan rate ie MCLR rate has increased to 8% for overnight tenure. Whereas, the MCLR rate has increased to 8.70% for one year tenure. The fund based loan rate of the bank i.e. MCLR has become 8.25% on the tenure of one month. MCLR has been applied at 8.35% for three months and 8.45% for six months tenure. At the same time, the MCLR rate has been increased to 8.7% for one year.

Which borrowers will be affected by the MCLR hike?

Bank of Baroda’s MCLR hike will affect only those customers whose interest rates are still based on MCLR. From October 1, 2019, banks have been given the freedom to link interest rates on their loans to external benchmarks such as repo rate, three or six month treasury bills or any other. There has been no change in the interest rates on repo rate based loans.