It is very convenient to make payment by cheque. But there are some special rules related to this. In such a situation, ignoring the rules can cost you dearly. Sometimes your small mistake can send you to jail for up to 2 years.

Cheque bounced: If you also find it easy to transact through cheque, then it is important for you to know about some rules related to it. Sometimes ignoring the rules or even a small mistake can cost you dearly. A small mistake can send you to jail for up to 2 years. The rules related to cheque keep changing from time to time.

One thing that has to be kept in mind while making payment through cheque. That is having sufficient amount in the account linked to the cheque. If your account does not have the amount written in the cheque, then it may get bounced and bounced cheque is a very dangerous situation.

Keep these things in mind while transacting through cheque.

If you transact through cheque, then you should especially remember these 5 things.

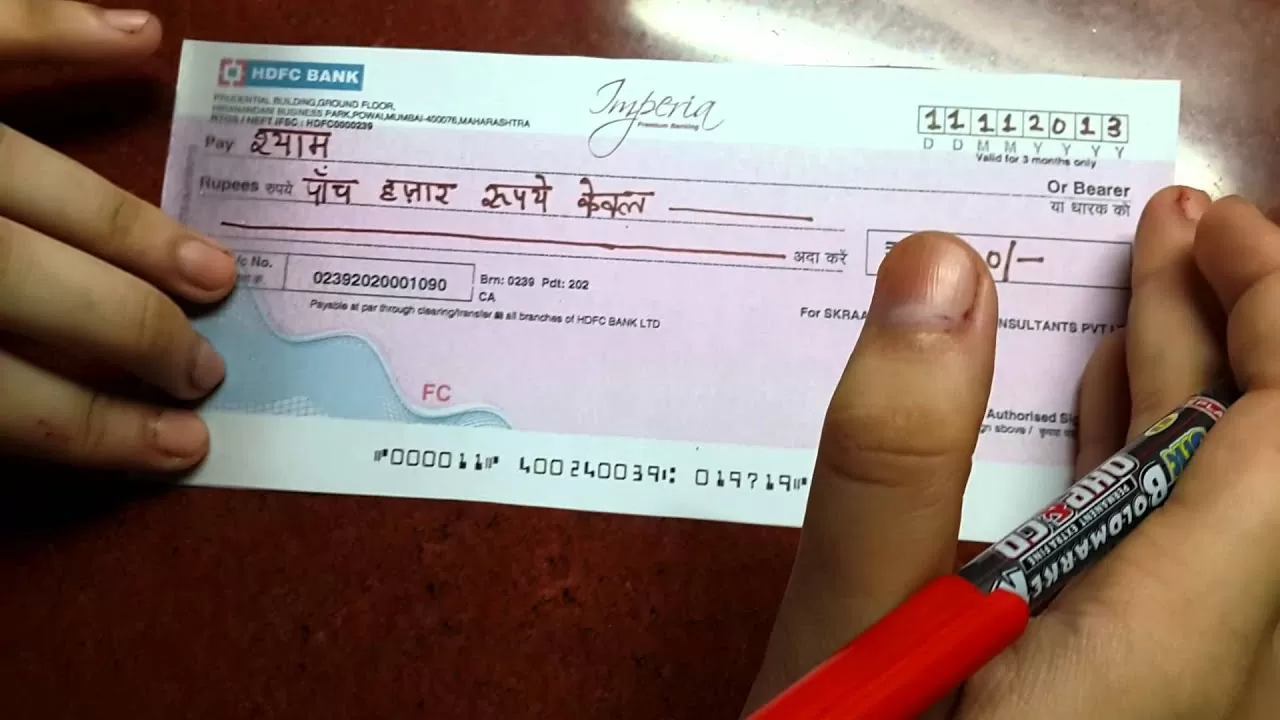

- You must fill in the details correctly on your cheque. For example, after writing the amount in figures, close it with (/-) sign and after writing the entire amount in words, write Only. This reduces the chances of your cheque being fraudulent.

- Mention clearly the type of cheque. Like whether it is an account payee cheque or a bearer cheque. What date is written on it? This information should be clear on the cheque.

- Not only this, you should also sign the cheque properly, so that it does not bounce. The signature of the cheque should match the bank’s records. If necessary, a signature should be put on the reverse side of the cheque, so that it becomes easier for the bank officer to match.

- The cheque should be written with such a pen that the information cannot be erased. If you do not do this then you may become a victim of fraud. The most important thing is that you start accepting pretend cheque only.

- Before issuing the cheque, ensure that there is sufficient balance in your account. If this does not happen, your cheque will bounce and in case the cheque bounces, you can be fined. Additionally, you may also be imprisoned for up to 2 years.

Rajkumar Santoshi got jail sentence

Recently, famous director Rajkumar Santoshi, who made powerful films like ‘Ghayal’ and ‘Damini’, has been sentenced to 2 years in jail in a cheque bounce case by a Jamnagar court. Rajkumar Santoshi had bounced 10 cheque one after the other, which he had given to Ashok Lal, an industrialist from Jamnagar. These were 10 cheque of Rs 10 lakh each and all the cheque amounting to Rs 1 crore had bounced. After this, court action took place and as per the court order, Rajkumar Santoshi was sentenced to 2 years in jail and the other party was asked to pay double the amount, about Rs 2 crore.