Federal Bank, one of the leading private sector lenders, raised its interest rates on fixed deposits below ₹2 crore. According to the bank’s official website, the new rates are in effect as of today, October 23, 2022. Following the adjustment, the bank increased its interest rate by 50 basis points on a 700-day tenure; for all other maturities, the interest rate remained the same. Due to the hike announced today, the bank will now provide fixed deposits maturing in 700 days with an inflation-beating return of 7.50% to the general public and 8.00% to senior citizens.

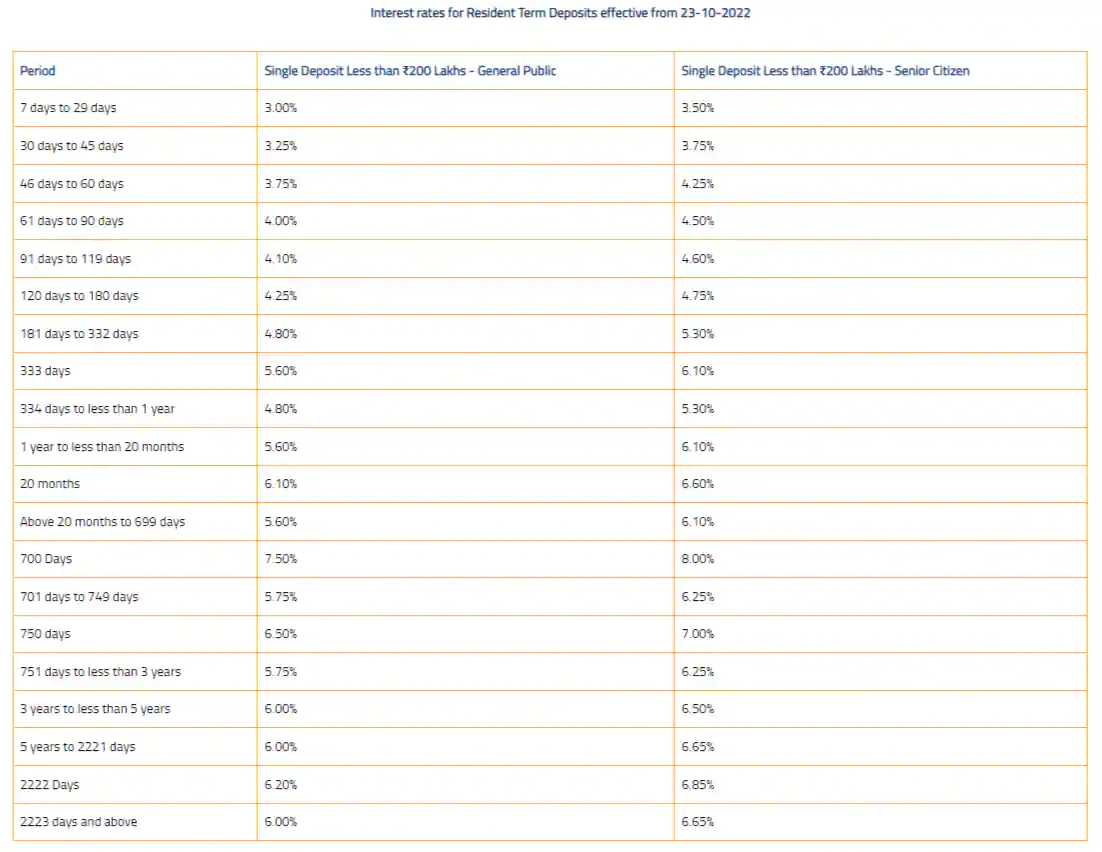

Federal Bank FD Rates

The bank is giving a 3.00% interest rate on deposits due in the next 7 to 29 days, and a 3.25% interest rate on deposits maturing in the next 30 to 45 days, according to Federal Bank. Deposits maturing in 46 days to 60 days will earn interest at a rate of 3.75% from Federal Bank, while deposits maturing in 61 days to 90 days will earn interest at a rate of 4.00%. Deposits that mature between 91 and 119 days will pay interest at a rate of 4.10%, while those that mature between 120 and 180 days will pay interest at a rate of 4.25%.

On deposits maturing in 181 days to 332 days the bank is offering an interest rate of 4.80% and on those maturing in 333 days, Federal Bank shall pay an interest rate of 5.60%. Deposits maturing in 334 days to less than 1 year shall pay an interest rate of 4.80% and those maturing in 1 year to less than 20 months shall pay an interest rate of 5.60%. Federal Bank is offering an interest rate of 6.10% on deposits maturing in 20 months and the bank is promising an interest rate of 5.60% on those maturing in Above 20 months to 699 days.

On deposits maturing in 700 Days, the bank has hiked the interest rate by 50 bps from 7% to 7.50% and on those maturing in 701 days to 749 days, the bank shall pay an interest rate of 5.75%. Fixed deposits maturing in 750 days shall pay an interest rate of 6.50% and deposits maturing in 751 days to less than 3 years shall pay an interest rate of 5.75%. On fixed deposits maturing in 3 years to 2221 days Federal Bank is offering an interest rate of 6.00% and on those maturing in 2222 Days and 2223 days and above the bank shall pay an interest rate of 6.20% and 6.00% respectively.

The bank has also changed the terms of the premature withdrawal penalties on rupee term deposits. On October 21, 2022, the new penalty charges went into force, according to the bank’s official website. Federal Bank’s standalone net profit soared to ₹703.7 crore as of Q2 FY23 from ₹460.3 crore as of Q2 FY22, a jump of over 53% YoY. From ₹1,479.4 crore in Q2FY22 to ₹1,762 crore in Q2FY23, the lender’s net income interest (NII) climbed by about 19% YoY. In contrast, its net interest margin (NIM) climbed to 3.30%. Federal Bank’s gross non-performing assets (NPA) were 2.46%, down from 2.69% in Q1FY23, the lowest it has been in 24 quarters.