FD Rates There is big news for the customers of India’s largest public sector bank Union Bank of India. The bank has once again changed the rates of its FDs. Let us know how much benefit will you get now?

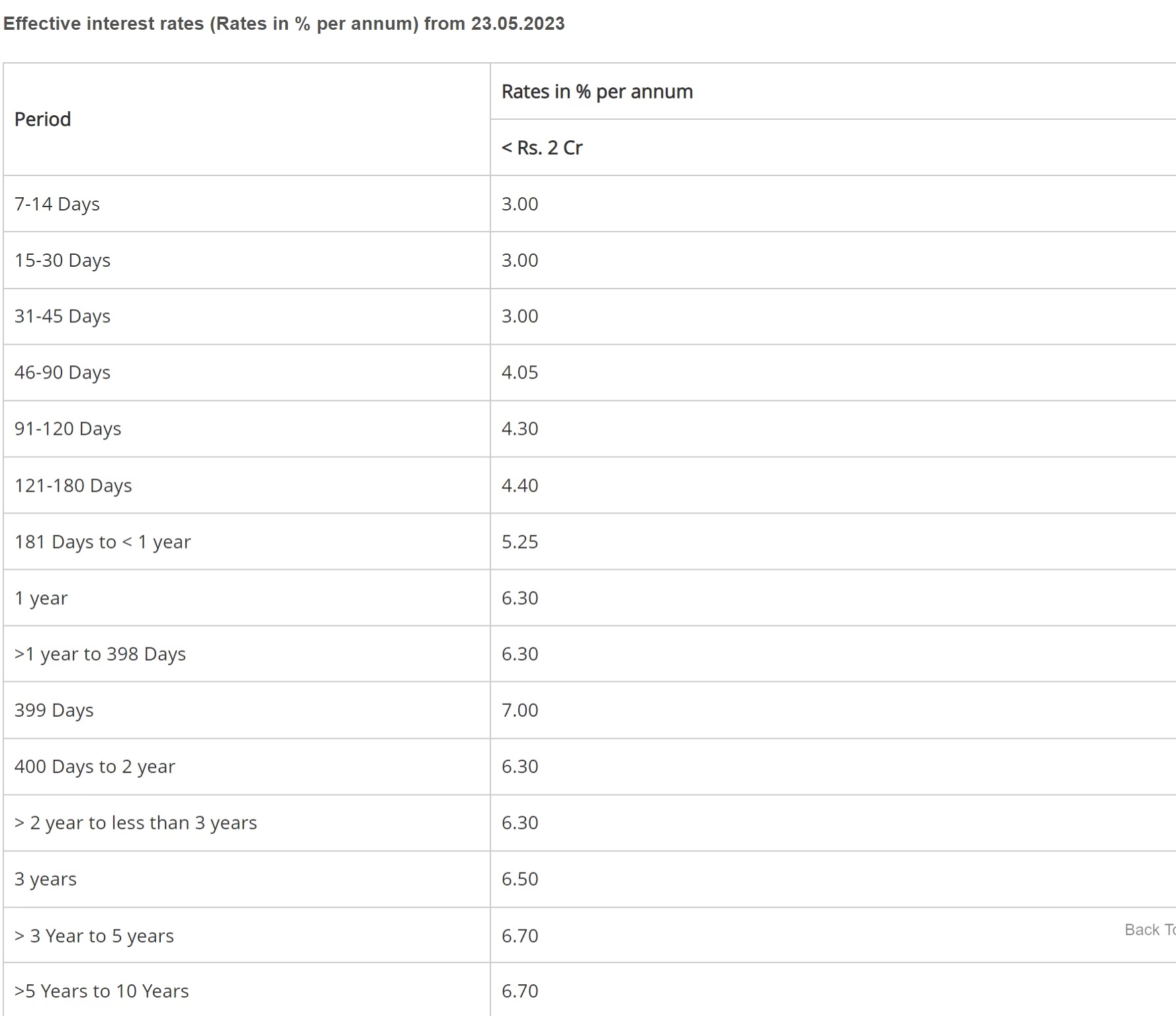

The public sector lender Union Bank of India has revised its interest rates on fixed deposits of less than ₹2 Cr. Following the revision, the bank is offering interest rates ranging from 3.00% to 6.70% on deposits maturing in 7 days to 10 years. On a tenure of 399 days, the bank is now offering a maximum interest rate of 7%. As per the official website of Union Bank of India, the new FD rates are effective as of today 23.05.2023.

Union Bank FD Rates

The bank is now giving a 3% interest rate on fixed deposits that mature in 7 to 45 days, while Union Bank of India is also offering a 4.05% interest rate on deposits that mature in 46 to 90 days. A deposit tenor of 91 to 120 days will now earn interest at a rate of 4.30%, while a deposit tenor of 121 to 180 days will earn interest at a rate of 4.40%.

Deposits that mature in 181 days to one year will now earn interest at a rate of 5.25%, while those that mature in one year to 398 days will now earn interest at a rate of 6.30%. The bank now offers a maximum interest rate of 7.00% on deposits maturing in 399 days, and Union Bank of India now offers a rate of 6.30% on deposits maturing in 400 days to three years.

The current interest rates offered by Union Bank of India are 6.50% for deposits with a term of three years and 6.70% for deposits with a term of three to ten years.

“Union Bank of India offers an additional rate component to resident senior and super senior citizens on term deposits up to Rs. 5.00 Crores in all of its domestic term deposits scheme. The additional rate component, applicable to resident senior citizen deposits is 0.50% over and above the normal rates displayed above. The additional rate component applicable to resident super senior citizens is 0.75% over and above the normal rate displayed above (0.25% over and above rate applicable to resident senior citizen). The additional rate on super senior term deposits would be applicable for the term deposits opened/renewed on or after 01.12.2022,” mentioned Union Bank of India on its website.

For the quarter ended March 31, 2023, Union Bank of India reported a 61.18 percent increase in net profit to ₹1,440 crore. The bank said that its net interest income (NII) was ₹8,251 crore, down 4.38 per cent from ₹8,628 crore in the third quarter of FY23 but up 17.92 per cent from NII of ₹6,769 crore in the year-ago quarter. The bank’s net interest margin (NIM) in Q4FY23 was 2.98 percent, up 13 basis points from the 2.75 percent in the March 2022 quarter but down 23 points from the 3.21 percent in Q3FY23. The bank’s global advances grew by 13.05 percent annually and 0.73 percent quarterly to ₹8,09,905 crore, while deposits increased by 8.26 percent annually and 4.95 percent quarterly to ₹11,17,716 crore.