Yes Bank, a private sector lender, has launched a special fixed deposit scheme that will go into effect today, October 12, 2022. This special FD programme is available for deposits of less than ₹2 Cr, and the bank offers inflation-beating returns to elderly persons. Today, the bank also revised its interest rates on fixed deposits under ₹2 crore, promising a maximum interest rate of up to 6.75% for the general public and 7.50% for elderly persons.

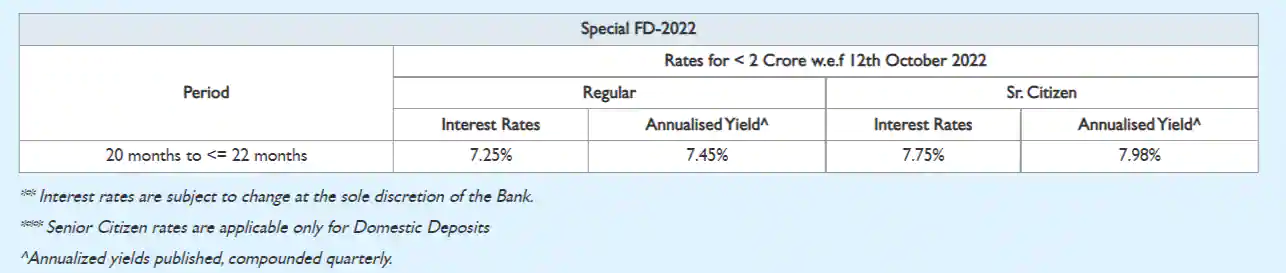

Yes Bank Special FD

Yes Bank special FD has a tenure of 20 months to 22 months and Yes Bank promises an interest rate of 7.25% for the general public and 7.75% for senior citizens on this special tenure bucket. Retail inflation in India, as measured by the Consumer Price Index (CPI), reached a five-month high of 7.41% in September 2022, up from 7% in August. Senior citizens can now successfully generate inflation-beating returns by booking a Yes Bank Special FD for the above-mentioned tenure.

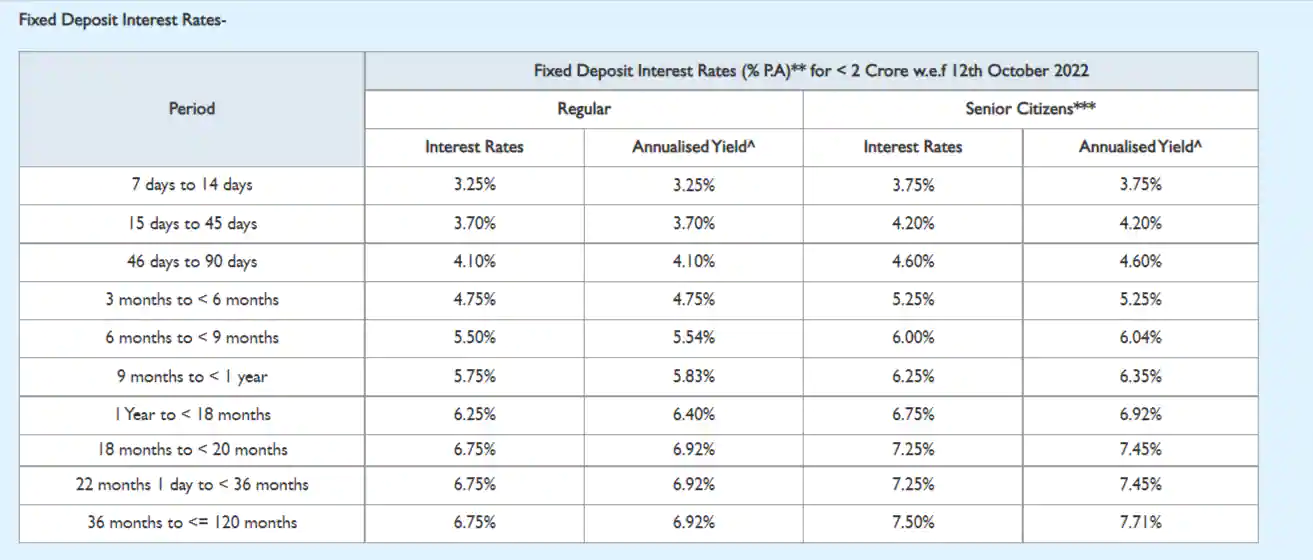

Yes Bank FD Rates

As per the official website of Yes Bank, the fixed deposit interest rates are effective as of 12th October 2022. On fixed deposits maturing in 7 days to 14 days the bank will pay an interest rate of 3.25% and on FD booked for 15 days to 45 days, Yes Bank will pay an interest rate of 3.70%. Deposits maturing in 46 days to 90 days will fetch an interest rate of 4.10% and deposits that mature in 3 months to 6 months will fetch an interest rate of 4.75%.

Yes Bank is offering an interest rate of 5.50% on FDs maturing in 6 months to 9 months and an interest rate of 5.75% on FDs maturing in 9 months to 1 year. Yes Bank will give a 6.25% interest rate on FDs maturing in 1 year to 18 months, and a 6.75% interest rate on FDs maturing in 18 months to 120 months. Yes Bank gives senior citizens an additional interest rate of 50 basis points on FDs maturing in 7 days to 36 months and an additional rate of 75 basis points on FDs maturing in 36 months to 120 months.

As a result of the RBI’s repo rate hike to 5.90%, most banks have raised their fixed deposit interest rates. AU Small Finance Bank, IDBI Bank, IDFC First Bank, HDFC Bank, Bank of Maharashtra, Dhanlaxmi Bank, Central Bank of India, Canara Bank, CSB Bank, Kotak Mahindra Bank, ICICI Bank, DCB Bank, Axis Bank, RBL Bank, Bank of India, Indian Overseas Bank and Karnataka Bank till now have announced hikes in fixed deposit interest rates. As retail inflation in India, as measured by the Consumer Price Index (CPI), approached a five-month peak of 7.41% in September 2022, up from 7% in August, the RBI is expected to raise the repo rate further at its upcoming MPC meeting in order to tame inflation, resulting in more interest rate hikes are deposits and loan products in the country may be witnessed soon.

Read Also: Government employees: Good News! Government hikes minimum wage. Check revised monthly salary here