RBI Holds Interest Rate Hike: The financial year 2022-23 is virtually a nightmare for borrowers. Because they have to deal with the shock of 250 basis points increase in repo rate. An estimated 136 percent increase in interest payments.

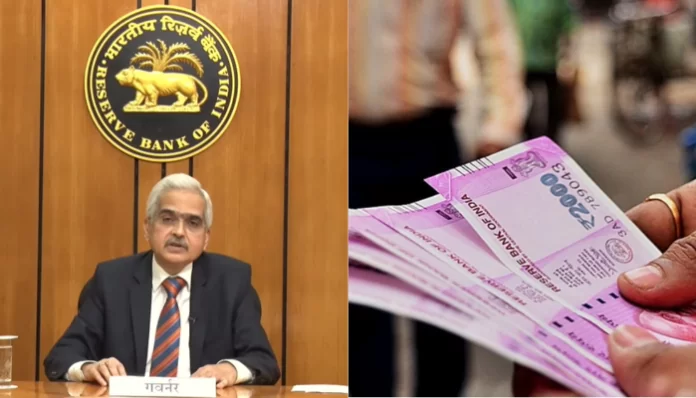

RBI Holds Interest Rate Hike: The last financial year saw continuous repo rate hike. As a result, the borrowers were virtually wiped out. But the Reserve Bank of India has brought relief for them in the financial year 2023-24. After the second monetary policy meeting of the current fiscal year, it was decided to keep the repo rate at 6.5 percent. That is, the repo rate has not been changed for the second time.

Today, June 8, the Reserve Bank’s Monetary Policy Committee announced the repo rate. After that, the relief of the borrowers increased. The Reserve Bank has increased the repo rate by 2.5 percent in just ten months from May 2022 to February 2023.

A major impact on rising interest rates

Borrowers who had taken external benchmark linked loans had to bear the brunt of the repo rate hike. Meanwhile, those who took loans directly linked to the repo rate were similarly under pressure. Because when the repo rate increases, the interest rate naturally increases in the case of floating rate. Most borrowers extend the loan term in such situations. However, such increase in interest rate leads to a situation where the option of extension does not work after a certain period of time. In that situation they were forced to increase the EMI.

Let’s say a person takes a loan of Rs 40 lakh at 7% for 20 years, here a 2.5% increase means your total interest payment increases from Rs 34.43 lakh to Rs 49.48 lakh. This is a massive increase of 44 percent in a short period of time. In such cases extension of time works to a limited extent. Even if you take it to a 20 to 30 year term in terms of current account, your EMI will increase by Rs.2622. That is, instead of 31012 rupees, you have to calculate 33634 rupees. In this case the total interest will increase from 34.42 to 81.08 lakhs. That is, if you go for the combination of tenure and EMI hike, the hike will be 136 percent.

Has the rate hike ended?

The Reserve Bank’s primary responsibility is to keep retail inflation within 2-6 percent. The war in Russia and Ukraine has disrupted supply chains. As a result, inflation started to rise. Sustained repo rate hikes helped the RBI bring inflation below 5 percent for the first time in April.

When can interest rates decrease?

The US central bank also raised rates at its last meeting. According to a report by ICICI Direct, the central bank has indicated that interest rates will not be hiked for the time being. This time RBI can focus on credit and other economic challenges.