The two most important things to get HRA Rebate are that you should be getting HRA amount as a part of your salary, and secondly, the house for which you are claiming rent should not be in your name…

HRA Rebate Calculation: One of the many such declarations related to savings is made by those who live in a rented house, and who are given HRA, i.e. House Rent Allowance or House Rent Allowance as a part of their salary. This HRA, i.e. House Rent Allowance can actually help the salaried people who live in a rented house while dreaming of their own house, save a lot of income tax, so it is very important that its declaration is made at the right time and in the right manner. But the problem is that many salaried people do not know how to calculate HRA Rebate, and also do not know how to get it, so today we have written this news to help you.

Who will get HRA Rebate, and how…?

To get HRA Rebate, any person must first understand who can get HRA exemption in income tax. So, remember, the two most important things for this are that you are paid an amount in the form of HRA (House Rent Allowance) as a part of your salary, and the second thing is that the house for which you are claiming to pay the rent should not be in your name. Under Section 10 (13A) of the Income Tax Act, any person receiving salary is given income tax exemption on the smallest of the three amounts – 50 percent of his basic salary, the amount received as HRA, or the amount of rent actually paid by him after deducting 10 percent of the basic salary.

Who can get how much HRA Rebate…?

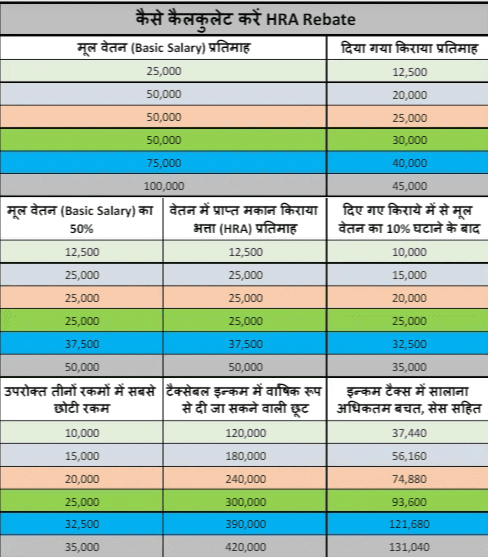

To understand this in detail, we have made this chart. This PDF chart gives an example of six salaried people who get ₹25,000, ₹50,000, ₹50,000, ₹75,000 and ₹1,00,000 as basic salary per month respectively. These people are also given 50 percent of their basic salary as HRA per month, and they pay ₹12,500, ₹20,000, ₹25,000, ₹30,000, ₹40,000 and ₹45,000 respectively as rent per month.

Now understand – the first person who gets a basic salary of ₹25,000 gets ₹12,500 as HRA, and he pays the same ₹12,500 as rent to the landlord every month, so 50 percent of the basic salary of this person is ₹12,500, he receives ₹12,500 as HRA, and after deducting 10 percent of the basic salary from the actual rent paid by him, the amount of ₹10,000 comes out. Now since the smallest of these three amounts is ₹10,000, as per the rule, this person will get HRA Rebate on the amount of ₹10,000 per month or ₹1,20,000 per year, i.e. ₹1,20,000 will be deducted from the taxable income of this person, and he will be able to save a maximum of ₹37,400 on this amount (in the case when the person is paying tax in the 30 percent slab, and this amount also includes 4 percent cess).

Similarly, the second person in the chart gets ₹50,000 as basic salary, and he gets ₹25,000 as HRA. This person pays ₹20,000 as rent every month. So, 50% of this person’s basic salary, i.e. ₹25,000, is deducted from the ₹25,000 received as HRA and half of the basic salary from the rent paid and the amount appears to be ₹15,000. Now for this person, the smallest of these three amounts is ₹15,000, so he will get HRA Rebate of ₹15,000 every month or ₹1,80,000 annually. In this way, this person will be able to save a maximum of ₹56,160 including income tax and cess.

The persons in the third and fourth examples get only ₹50,000 as basic salary and ₹25,000 as HRA, but they pay ₹25,000 and ₹30,000 per month respectively as rent. Now 50 percent of the basic salary and the HRA received by both of them will remain ₹25,000 only, but after deducting 10 percent of the basic salary from the rent paid, the amounts received will be ₹20,000 and ₹25,000 respectively. On this basis, the HRA rebate they get annually will also be ₹2,40,000 and ₹3,00,000 respectively, on which they will be able to save a maximum of ₹74,880 and ₹93,600 respectively in income tax annually.

The fifth person in the chart got ₹75,000 as basic salary and gets ₹37,500 as HRA. The same person pays ₹40,000 as rent every month. Now this person’s basic salary is half of ₹37,500, he gets ₹37,500 HRA, and after deducting 10% of the basic salary from the rent amount, he gets ₹32,500. Therefore, he can get HRA Rebate of ₹32,500 per month or ₹3,90,000 per year, based on which he can save a maximum of ₹1,21,680 in income tax.

The last example is of a person whose basic salary is ₹1,00,000 per month, he gets ₹50,000 as HRA, and he pays ₹45,000 as house rent. Now this person will have three amounts – ₹50,000, ₹50,000 and ₹35,000. So, by taking HRA Rebate on the smallest of these three amounts, i.e. ₹35,000 per month or ₹4,20,000 annually, he can save a maximum of ₹1,31,040 in income tax.

Important things to remember…

By the way, those who wish to get HRA Rebate should remember one more thing. If you are paying house rent of more than ₹1,00,000 per annum (i.e. ₹8,333 per month), then you will also have to compulsorily enter the PAN number of your landlord (even if they are your parents or wife), and the landlord will have to pay income tax on this rental income. And yes, don’t forget – to get HRA Rebate, you must also have house rent receipts, which you will have to submit in the office.