Indian Railway: Taking lessons from the horrific train accident in Balasore, Odisha, Indian Railways has started a big facility for its passengers. Now passengers will be given a security of Rs 10 lakh as soon as they book the ticket. Till now the passengers used to choose this facility on their own.

New Delhi. Taking lessons from last month’s train accident in Balasore, Odisha, Indian Railways has started a new facility for its passengers. 70 percent of the passengers who lost their lives in the Balasore accident had not opted for the insurance offered by the Railways and were deprived of this special facility. Under the new system, now passengers will get the protection of insurance as soon as they book tickets. In return for this, the expenditure will also be very less.

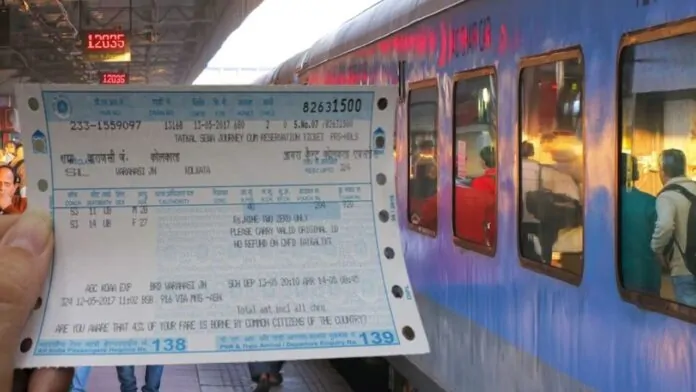

Actually, Railways has made the facility of insurance given at the time of booking tickets from IRCTC by default. This means that now passengers will not have to choose a separate option for this facility, rather this option will automatically be selected at the time of ticket booking. Under this facility, Railways gives insurance cover up to Rs 10 lakh in case of an accident. Its cost is also only 35 paise. Till now this facility of personal accident insurance cover was optional and its choice depended on the wishes of the passengers.

Railways found that a large number of passengers did not opt for this facility. A senior railway official says that keeping in view the interests of the passengers, this facility has now been made automatic. Now there will be no need to select it at the time of ticket booking. The passenger will automatically get this facility along with the ticket. Actually, most of the passengers who were victims of Balasore accident had not opted for this facility and they missed out on getting a bigger cover. Keeping this in mind, now the Railways has made this facility automatic.

You can also leave the option,

It is not that the Railways is forcing this insurance with personal accident cover on the passengers. If the passengers do not have the intention, then they can also leave this option. For this, they now have to click on the opt out option. But, for the insurance facility of 10 lakhs, Railways is taking only 35 paise, so leaving it will not be considered a right step. Under this insurance, compensation is given for loss of life or disability in case of a train accident and the cost of treatment for injuries.

What happened in the Balasore accident,

The officer associated with the case says that this facility has been started after taking lessons from the Balasore accident. On taking this insurance from IRCTC, insurance cover is given by SBI General Insurance Company Limited and Liberty General Insurance Company Limited. Last month, 288 passengers lost their lives in the Balasore accident, while more than 1,000 people were injured.

How many people got the cover

According to the information provided by the Insurance Regulatory and Development Authority (IRDAI), 624 passengers who became victims of the Balasore accident had taken this insurance cover. Out of this, a total of Rs 60.52 lakh was paid for the treatment expenses under 22 claims. However, not a single death was claimed. Liberty Insurance Company received 5 claims, out of which Rs 17,800 has been paid on two claims and Rs 6 lakh is yet to be paid on 3 claims. SBI General Insurance received 17 claims in which 50.52 lakh has been claimed for disability and treatment. So far 2 claims of Rs 2.25 lakh have been settled.