Long term investment can easily make you a millionaire. If you are employed, start investing as soon as possible.

Becoming a millionaire is like a dream for a middle class. If you want to fulfill this dream then the best way to do it is investment. Long term investment can easily make you a millionaire. If you are employed, start investing as soon as possible. The longer you invest, the better returns you will get. Know here about such a government scheme which can make you a guaranteed millionaire in 25 years. Know how much you will have to invest for this.

You can become a millionaire in 25 years

We are talking about Public Provident Fund i.e. PPF. This scheme is run by the Government of India. Any Indian citizen can invest in it. You can invest a maximum of Rs 1.5 lakh annually in PPF. Accordingly, you will have to invest at least Rs 12,500 every month. At present, 7.1 percent interest is being given on PPF. If you start investing in this scheme even at the age of 30, you can become a millionaire by the age of 55 and secure your old age. One advantage of PPF is that the money deposited in it, the interest received and the amount received on maturity are completely tax free. Meaning it is kept in EEE category.

How to become a millionaire

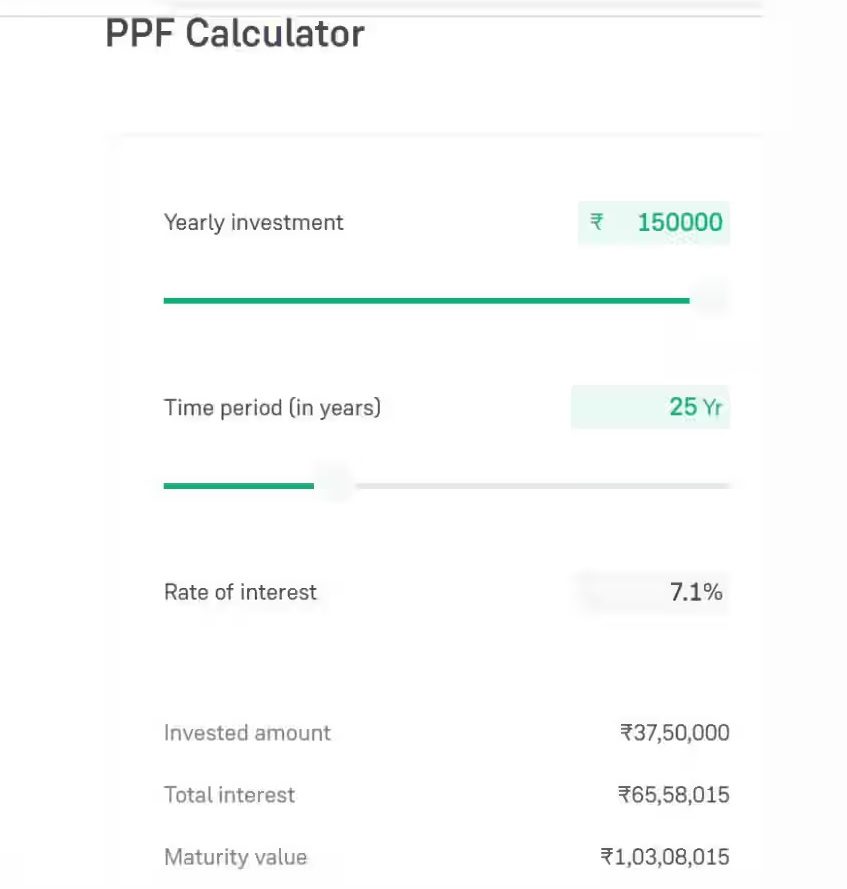

Although the PPF scheme is for 15 years, it can be extended in blocks of 5 years. If you deposit Rs 1.5 lakh annually in this, then deposit it continuously for 25 years. For this you will have to get PPF extension done twice. According to the PPF calculator, you will invest Rs 37,50,000 in 25 years. You will get Rs 65,58,015 as interest. In this way, after 25 years you will get a total of Rs 1,03,08,015.

If salary is 65-70 thousand then annual investment of 1.5 lakh is not a big deal.

If you are wondering how to get Rs 1.5 lakh annually for investment, then it is not a big deal in today’s time. The financial rule says that every person should save at least 20 percent of his income and invest. Even if you earn Rs 65-70 thousand a month, it is not a big deal. 20% of Rs 65,000 is Rs 13,000 and you have to save only Rs 12,500 in a month. In such a situation, you can easily make this investment and add a fund of Rs 1 crore till your retirement age.