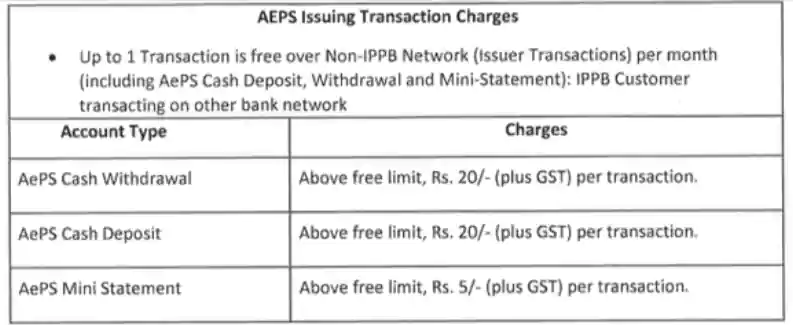

India Post Payments Bank: The Aadhaar Enabled Payment System (AePS) service charges have been revised by India Post Payments Bank (IPPB). Effective on December 1, 2022, the updated AePS Issuer transaction costs will be in effect. According to a notification on the IPPB website, up to 1 transaction is free over Non-IPPB Network (Issuer-Transactions) per month (including AePS Cash Deposit, Withdrawal and Mini-statement).

IPPB AePS service charges

For AePS cash withdrawal and deposit transactions, IPPB will charge a service fee of ₹20 plus GST per transaction if the free limit exceeds. For AePS mini statement, IPPB will impose a service charge of ₹5 plus GST per transaction if the free limit exceeds.

As per the data available on the National Payments Corporation of India (NPCI) website, “AePS is a bank led model which allows online interoperable financial inclusion transaction at PoS (MicroATM) through the Business correspondent of any bank using the Aadhaar authentication.AePS allows you to do six types of transactions.”

“The Aadhaar Enabled Payment System (AePS) is a bank-led model developed by NPCI, which allows online transactions at Micro ATM/Kiosk/mobile devices through the authorised Business Correspondent (BC) of any bank using Aadhaar authentication. This solution has been designed by NPCI to handle various kinds of service requests effectively by enabling an authentication gateway for all Aadhaar linked account holders. Any resident of India having an Aadhaar number linked to a bank account – referred to as an Aadhaar Enabled Bank Account (AEBA) – can utilise the AePS service,” said NPCI in a statement.

“The NPCI AePS solution can be accessed at any biometric-enabled touch-point via Micro ATMs, which may be all-in-one integrated devices, or mobiles /PCs/tablets, with accessories that meet technical specifications defined by UIDAI. AePS also enables Aadhaar seeding status check for Direct Benefit Transfer beneficiaries to receive DBT, Social Security Pension or government subsidies,” according to NPCI.

For conducting an AePS transaction, one only needs to enter his or her bank name, Aadhaar number, and fingerprint that was taken during enrolment. Customers may access the Cash Deposit, Cash Withdrawal, Balance Enquiry, Mini Statement, Aadhaar to Aadhaar Fund Transfer, Authentication, and BHIM Aadhaar Pay banking services offered by AePS by entering the said credentials. In addition to these, AePS also offers eKYC, Finger Detection, Demographic Authentication, Tokenization, and Aadhaar Seeding Status services. To open an Aadhaar-enabled bank account with a recognised bank and use the AePS service range, customers must have a valid Aadhaar number.