Income Tax Rules: Before filing income tax return, compare the tax liability under the new and old tax regime. Click on the Income Tax Calculator link for tax liability calculation.

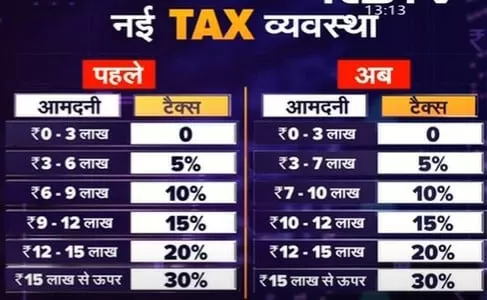

Income Tax Rules: A big announcement has been made regarding income tax in the budget. Under the new tax regime, the standard deduction limit has been increased to 25000. After which, now the scope of standard deduction or 80C has increased to 75000 under the new tax regime. At the same time, changes have also been made in the income tax slab under the new tax regime. Under this, if your income is less than Rs 3 lakh annually, then you will not have to pay tax. Here you can see the new tax slabs under the new tax regime.

The deadline for filing income tax for the financial year 2023-24 is July 31. There is a lot of confusion among taxpayers about the old tax regime and or the new tax regime. There are many questions in the mind of every salaried class about this. Which we are going to talk about here. First of all, let us tell you that under the current Income Tax Act, taxpayers are being allowed to choose either the Old Tax Regimes or the New Tax Regimes for tax deduction on salary. This option is applicable for the entire financial year.

From April 1, 2023, if an individual taxpayer has not opted for the Old Tax Regime, then his employer will deduct tax from his salary based on the New Tax Regime. This is because the new tax regime has been implemented as the default option from the financial year 2023-24. At the same time, no changes have been made in the Income Tax Rules in the Interim Budget 2024. Therefore, the new tax regime will remain the default option for the current financial year 2024-25 as well.

For which taxpayers will the new tax regime default apply?

According to the Income Tax Department website, the default option of the new tax regime for tax deduction on salary will be applicable to:

- Individuals

- Hindu Undivided Family (HUF) (except co-operative society)

- BOI

- Artificial Juridical Person

Is it possible to switch tax regime while filing ITR?

It is possible to switch to Old or New Tax Regime while filing ITR. You can do this by selecting the option while filing your Income Tax Return (ITR Filing). You have to select a checkbox for Old or New Tax Regime and provide details in Form 10IE.

According to the income tax website, if you want to opt for the old tax regime and you are eligible to file returns in ITR 1 and 2, then directly choose the corresponding option in ITR and file the return within the prescribed due date. If you are eligible to file returns in ITR 3, 4 and 5, then you must file Form 10-IEA before the due date under section 139(1).

Compare liabilities before filing ITR

However, before filing income tax return (ITR Filing 2024), do compare tax liabilities under the new and old tax regime. Click on the Income Tax Calculator link for tax liability calculation.

In the ITR form, the person is asked “Do you wish to opt out of the new tax regime under section 115BAC(6)? (Default is No)”. If you choose no, your tax liability will be as per the new tax regime slabs. While choosing yes means that you are opting for the old tax regime. In such a case, you will pay tax as per the income tax slabs under the old tax regime.

How many times can I switch income tax regime?

You can switch between the new and old tax regime every year. But it is important to note that this facility is only for the salaried class, who do not have any business income. If you have a business, then you cannot switch between the two regimes.

If you want to choose the old tax regime while filing your ITR, then file ITR on or before the prescribed deadline. If you delay in this, tax calculation will be done according to the new tax regime.