LIC Aadhaar Shila plan is exclusively for women. In this plan, a fixed amount is paid on maturity.

LIC Aadhaar Shila: Life Insurance Corporation of India brings a variety of schemes for the different needs of the customers. In this episode, LIC’s foundation stone policy is a better option for investment for people with low income group. However, this scheme is available only for women.

LIC Aadhaar Shila Plan is a non-linked, individual life insurance scheme exclusively for women. In this plan a fixed payout is made on maturity and financial assistance is provided to the family in case of unfortunate death of the policyholder during the policy term.

Why this plan is special for women

According to investment advisor, Sweety Manoj Jain, only women having Aadhaar card are eligible to invest in this scheme. In this, the minimum age is 8 years and the maximum age is 55 years. That is, this policy can also be taken in the name of an 8 year old girl. The policy term is between 10 to 20 years. The sum insured under this plan ranges from Rs 2 lakh to a maximum of Rs 5 lakh. Loan facility is also available in this policy after 3 years.

How to get 6.5 lakhs on maturity

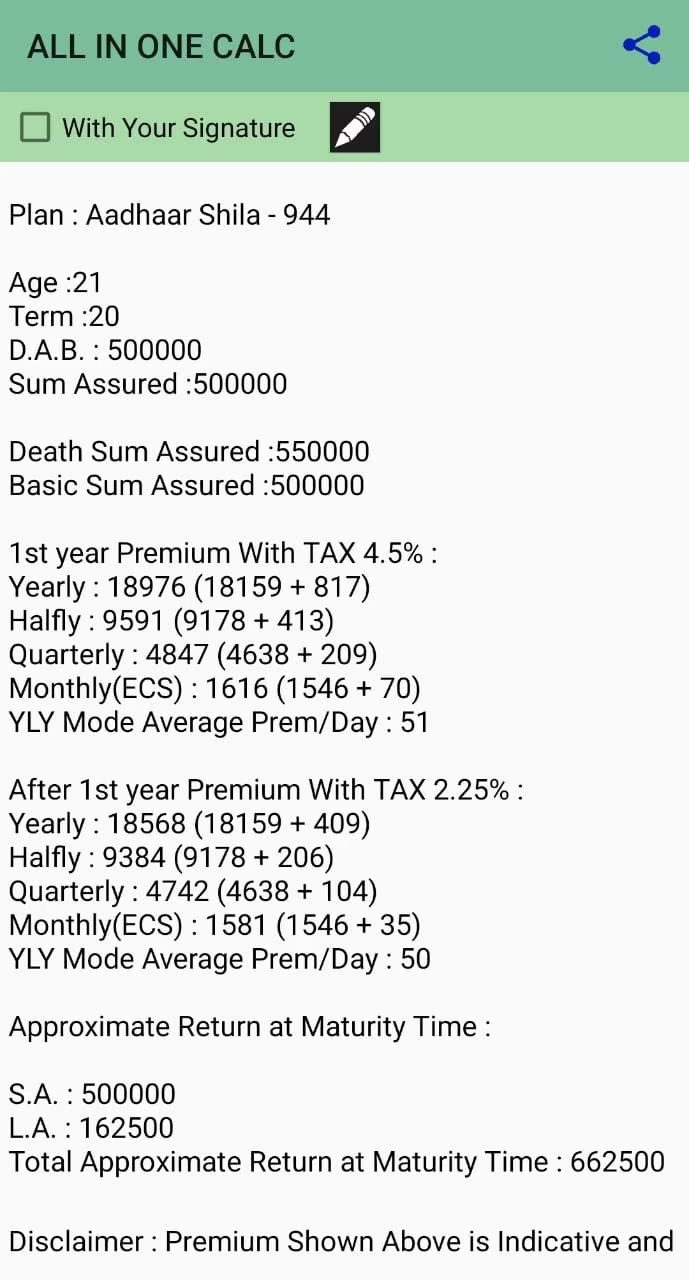

Suppose, a girl at the age of 21 years takes Jeevan Aadhaar Shila plan for 20 years, then she will have to deposit Rs 18,976 annually as premium. In this way, about 3 lakh 80 thousand rupees will be deposited in a period of 20 years and 6 lakh 62 thousand rupees will be received on maturity. There will be 5 lakh Basic Sum Assured and 1,62,500 Loyalty Addition.

However, the calculation given here regarding premium and maturity is tentative. This calculation is also applicable for taking a plan for an 8-year-old girl. The special thing is that there the amount of premium will be reduced. Therefore, for more information, LIC office has to be contacted. Another special feature of this policy is that on maturity, if the policyholder wishes, he can also get the maturity money in installments every year.

In this scheme, on the death of the policyholder, the sum assured is paid to the nominee. This amount can be up to 7 times the annualized premium or up to 110 percent of the Sum Assured. At the same time, loyalty addition is also available in this plan along with the sum assured on maturity.