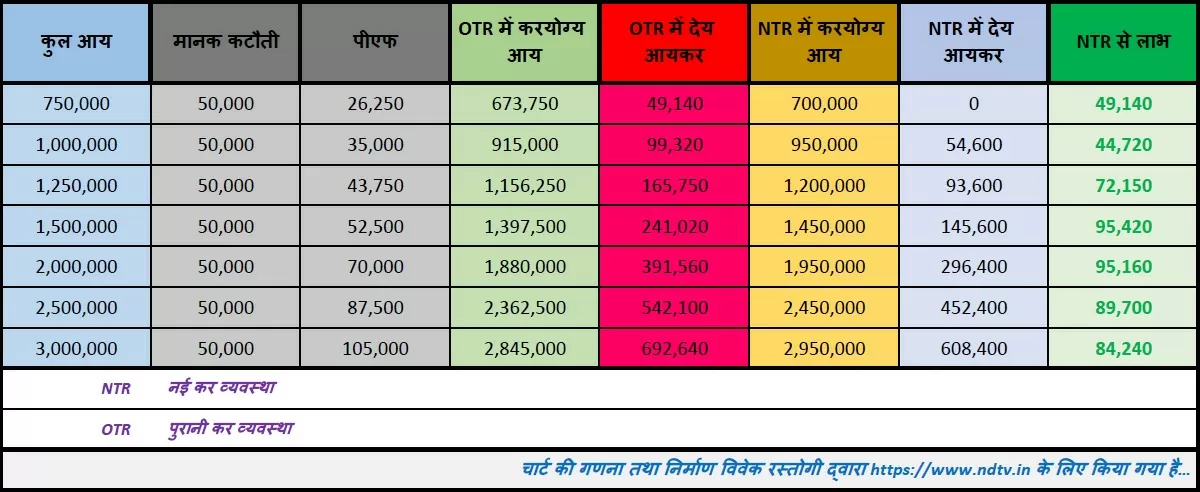

New Income Tax Regime: To understand how much a person earning how much per annum will benefit from adopting the New Income Tax Regime, look at the chart shown in the news. The chart gives examples of 7 employed people with different incomes, who earn ₹7,50,000, ₹10,00,000, ₹12,50,000, ₹15,00,000, ₹20,00,000, ₹25,00,000 and ₹30,00,000 per year respectively…

New Income Tax Regime: Income Tax is an essential part of the life of every earning person in the country. Salaried people get their salary only after the income tax has been deducted, so it is very important for every person to know how much income tax he will have to pay, or which income tax system, i.e. which regime he will benefit from.

It is worth noting that while presenting the general budget of the year 2020 in the Parliament, Finance Minister Nirmala Sitharaman announced the new tax regime under section 115BAC of the Income Tax Act. Under the new tax regime, the income tax slab was changed with the aim of giving benefits to the taxpayers, and the rates were also reduced, but all kinds of exemptions available under different sections of the Income Tax Act were completely abolished. On the other hand, the old tax regime was retained to give relief to salaried people who had the habit of saving, but the tax rates for them were also kept the same.

In the new tax system, people earning less than ₹7 lakh get complete exemption from income tax, whereas in the old tax system, this exemption is available only to those whose taxable income is less than ₹5 lakh. In the new tax system, there is no tax on income up to the first ₹3 lakh, 5 percent tax is levied on the next ₹3 lakh, i.e., ₹3 lakh to ₹6 lakh, 10 percent tax is levied on income from ₹6 to 9 lakh, 15 percent tax is levied on income from ₹9 to 12 lakh, and 20 percent tax is levied on income from ₹12 to 15 lakh. 30 percent tax is levied on income above ₹15 lakh.

If you look carefully, the new tax system is very beneficial for all those who do not invest in savings schemes (PPF, NSC, Life Insurance Policy etc.), or who have not built a house by taking a loan from the bank, or who do not live in a rented house, or do not get tax exemption on the House Rent Allowance (HRA Rebate) received in the salary.

How much income will a person earning how much benefit in income tax…

Now to understand how much benefit a person earning how much can get by adopting the new tax system, look carefully at the chart shown below these lines. Here we have given examples of 7 employed people with different total incomes, who earn ₹7,50,000, ₹10,00,000, ₹12,50,000, ₹15,00,000, ₹20,00,000, ₹25,00,000 and ₹30,00,000 every year respectively. In this chart, the second column shows the benefit of Standard Deduction, which is only ₹50,000 in the new and old tax system. The third column of the chart mentions the estimated amount to be deposited in the Provident Fund from the salary of all the seven taxpayers, and this amount can be exempted only in the old tax system. The next column of the chart mentions the taxable income as per the old tax system, and the next column shows the income tax payable under the old tax system, which also includes 4 percent cess. After this, the chart shows the taxable income under the new tax system, in which PF is not deducted, and only the benefit of Standard Deduction is given as per the rules. The next column of the chart shows the payable income tax of all the seven taxpayers, and then the last column tells how much benefit all the seven taxpayers will get by switching to the new tax system as compared to the old tax system.

If the annual income is ₹7.5 lakh…

The first person shown in the chart will be given the benefit of only standard deduction in the new tax system, due to which his taxable income will be considered as ₹7,00,000, and under the new rules, he will get exemption under Section 87A of the Income Tax Act, and he will not have to pay any income tax, that is, this person will get a benefit of ₹49,140 compared to the income tax payable in the old tax system.

If the annual income is ₹10 lakh…

A person earning ₹10 lakh every year will have to pay ₹99,320 as income tax if he is in the Old Tax Regime, due to Standard Deduction and PF deposits, but in the new tax system, this person will have to pay only ₹54,600 income tax on the same income, that is, he will get a benefit of ₹44,720.

If the annual income is ₹12.5 lakh…

A person whose annual income is ₹12,50,000 will have to pay ₹1,65,750 income tax under the old tax system, whereas the same person will have to pay only ₹93,600 under the new tax system, i.e. this person will get a benefit of ₹72,150.

Those earning ₹15 lakh will get the most benefit…

A person with an annual income of ₹15 lakh will have to pay only ₹1,45,600 under the new tax system, whereas in the old tax system the same person will have to pay ₹2,41,020 income tax on the same income, so, this person will get a benefit of ₹95,420.

If the annual income is ₹20 lakh…

If a person earns ₹20 lakh annually and remains in the old tax system, he will have to pay ₹3,91,560 as income tax, but if the same person adopts the new tax system, his income tax payable will be ₹2,96,400, i.e. this person will also save ₹95,160 in a year.

If you earn ₹25 lakh…

A person whose annual income is ₹25 lakh will have to pay ₹5,42,100 as income tax if he remains in the old tax system, but the same person will have to pay only ₹4,52,400 as income tax in the new tax system, so, here also there is a surety of a benefit of ₹89,700 on adopting the new tax system.

If the annual income is ₹30 lakh…

The last person in the chart, who is earning ₹30,00,000 annually, his taxable income would be ₹28,45,000 in the old tax system, and he would have to pay ₹6,92,640 as income tax, whereas the same person will get a benefit of ₹84,240 after coming under the new tax system, and will have to pay only ₹6,08,400 as income tax.