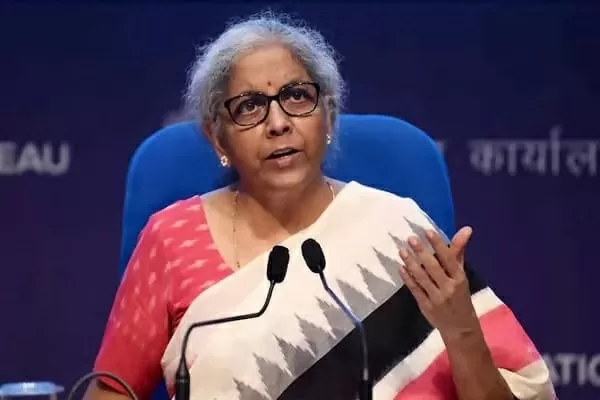

Budget 2024: Finance Minister Nirmala Sitharaman will present the budget on 1 February 2024. Taxpayers have many expectations from this budget. Although Nirmala Sitharaman has refused to make any major announcement in the budget this year, the common man still has the hope that some relief can be found on the income tax front.

Budget 2024: Finance Minister Nirmala Sitharaman will present the budget on 1 February 2024. Taxpayers have many expectations from this budget. Although Nirmala Sitharaman has refused to make any major announcement in the budget this year, the common man still has hope that some relief can be found on the income tax front. In such a situation, will the old income tax slab increase or not? What other steps can be taken to make the new slab more attractive. Amarjeet Chopra, former chairman of ICAI and expert on direct tax, talked with us on this.

Is there scope for changes in the old tax?

In the budget, everyone wants that some changes should be made in the old income tax regime. According to the new tax regime, the taxable income limit should be increased to Rs 7 lakh. The government’s focus is that taxpayers should choose the new tax regime, so there is less scope for changes in the old tax regime. The government also would not like to reduce the income from income tax. So the government will have to maintain a balance on both sides.

The expectations of taxpayers are that the limit in the old tax regime should be increased, but the chances of this happening are less. Most of the taxpayers are hoping that the government increases its limit to Rs 7 lakh.

There should be discount on home loan

To boost the real estate sector and fulfill people’s dream of owning their own home, the government needs to increase the rebate on home loans. The government needs to increase the rebate on home loan interest to Rs 5 lakh. This will also give a boost to the real estate sector. Also, people will be more motivated to buy their house.

Some changes are needed in the new tax regime

Salary class home loan takers are reluctant to migrate from the old tax regime to the new tax regime. In such a situation, what should the government do to target the salary class? On this he said that the government should include exemption for home loan taxpayers in the new tax regime. More people would like to move towards the new tax regime.