Budget 2024: In this news, we will assess the taxes applicable in the old tax system and the new tax system and will also explain through a table how much tax you will have to pay if you live in which system.

Presenting the interim budget for the financial year 2024-25, Finance Minister Nirmala Sitharaman has announced that no change of any kind is being made in the income tax slabs or rates. As a result, the new and old tax systems will remain intact. Along with this, taxpayers will also remain confused as to which of the two tax regimes they will benefit from more. Come, let us explain to you in detail what is the difference between the two systems, and how much tax a person earning will have to pay in which tax regime. Through the chart given to you, it will be easier for you to understand how much benefit you will get from which tax system.

Last year, i.e. in the General Budget 2023, Union Finance Minister Nirmala Sitharaman had made changes in the rules related to Income Tax Regime. The Finance Minister had declared the new tax system as the default system, but did not abolish the old tax system. That means taxpayers will still be able to choose the old tax system. Under this system, people who want to continue getting exemptions like life insurance, PPF, children’s school fees etc., interest on home loan, National Pension System (NPS) or house rent allowance, will be able to continue paying tax at the old rates.

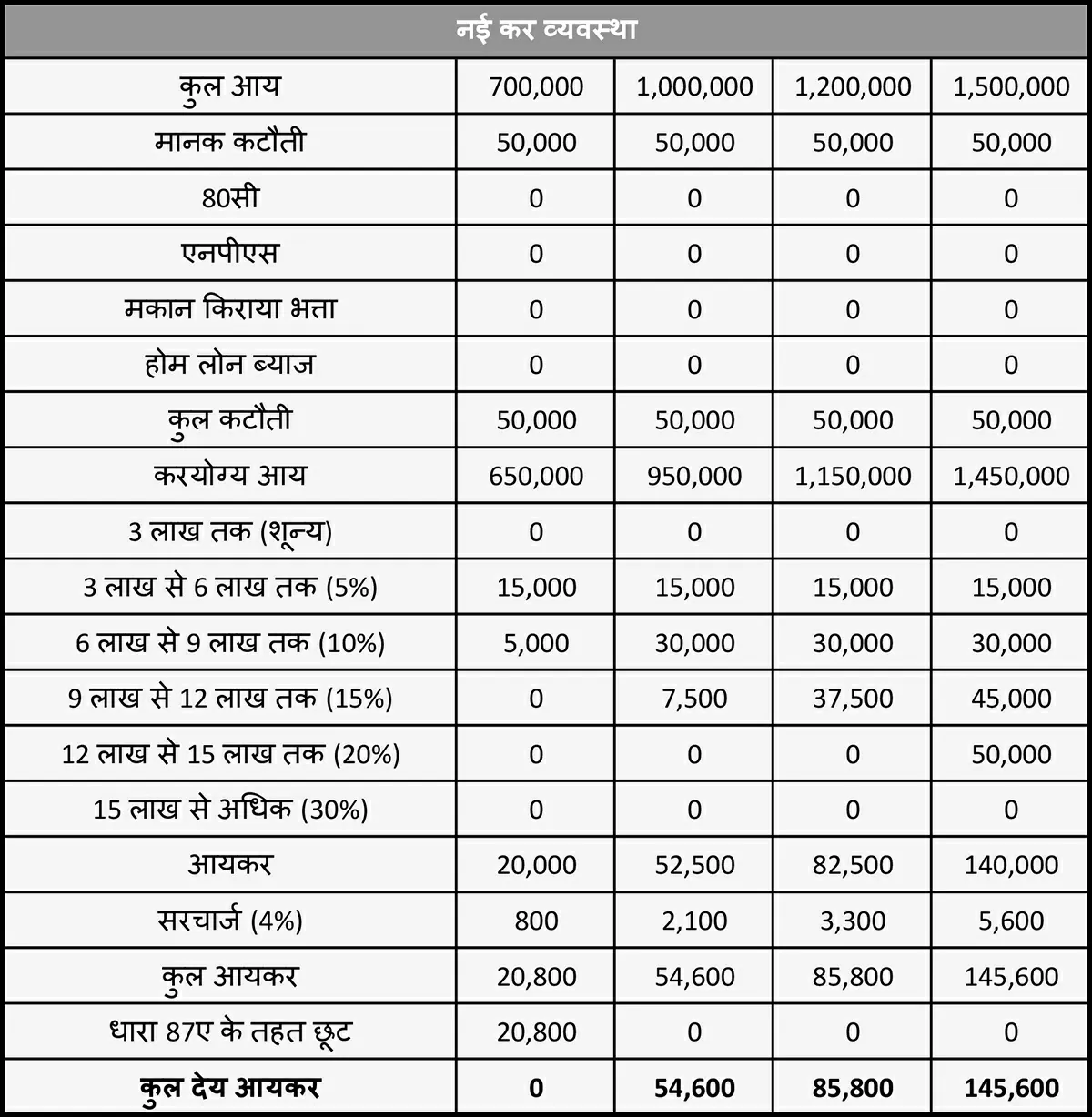

Come, we will also explain to you through a table the amount of tax to be paid in the old tax system and the new tax system and how much tax you will have to pay if you live in which system. We have taken examples of four employed people whose income is Rs 7 lakh per annum, Rs 10 lakh per annum, Rs 12 lakh per annum and Rs 15 lakh per annum respectively. These people also get exemption under Section 80C of the Income Tax Act, exemption in the form of house rent allowance or home loan interest, exemption under NPS etc. So under which system, who will have to pay how much tax, understand from these 2 tables.

Old Income Tax Regime

In the first table with the old tax system, you will see, all four people have got the benefit of standard deduction, all four have made maximum savings under Section 80C, all four people have also invested Rs 50,000 in NPS, and house rent Exemption has also been availed on allowance or interest paid on home loan. In the first table (old tax system), the taxable income of the first person with an annual income of Rs 7 lakh after getting all the exemptions has come down to Rs 3,70,000, on which his tax liability is Rs 6,240, despite the income under Section 87A of the Income Tax Act. After the exemption given under this has become zero. After total deductions and exemptions of Rs 4 lakh, the taxable income of another person with annual income of Rs 10 lakh comes down to Rs 6,00,000, on which he has to pay income tax of Rs 33,800. Similarly, in the old system that incorporates exemptions and deductions, people earning Rs 12 lakh and Rs 15 lakh per year will have to pay income tax of Rs 75,400 and Rs 1,06,600 respectively.

New Income Tax Regime