NSC Calculator Post Office : The government has increased the interest rates in many small savings schemes of the post office, including NSC, from April 1, 2023. Now you are getting interest on it at the rate of 7.7%.

NSC Calculator Post Office 2024: Investment in Post Office Schemes still remains the choice of common people for safe and guaranteed returns. The government has increased the interest rates on many small savings schemes of the post office, including NSC or National Savings Certificate, from April 1, 2023. Now you are getting interest on it at the rate of 7.7%. NSC is one of the popular savings schemes of the post office. This scheme is run by the government, due to which you are guaranteed safe returns. You can start investing in this scheme by visiting any post office branch. The best thing is that by investing in the scheme, you get the benefit of compounding interest (NSC Interest Rate Calculator).

NSC interest rate and maturity period

There are two types of NSC – NSC VIII Issue and NSC IX Issue. But currently only the eighth issue is available for investment. The ninth issue has been discontinued since December 2015. The eighth issue comes with a lock-in period of 5 years, on which you get 7.7% annual interest. That means after five years you get back both the principal amount and interest money. On top of that, you also get tax exemption under Section 80C of Income Tax on initial investment and interest for the first four years. You get rebate on investment up to Rs 1.5 lakh.

NSC Calculator: How much interest will you get on investment in NSC?

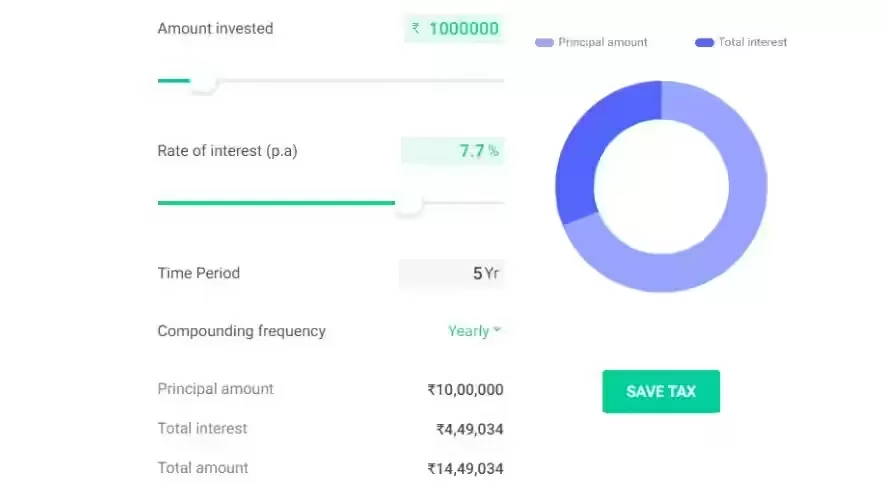

Suppose you invest Rs 10 lakh in NSC. On this you will get return at the rate of 7.7% per annum (NSC Interest Rate). Your investment will remain in lock in period for 5 years. So according to the calculator, your principal amount is Rs 10 lakh, on this you will get Rs 4,49,034 only from interest. And by including the principal amount and interest, you get a full return of Rs 14,49,034 on your investment.

How do you get money after maturity?

When your investment in NSC becomes mature (NSC maturity period), you can withdraw it in cash. You can also choose the option to transfer this amount to your bank account. If you do not withdraw this money and leave it lying in NSC, then you continue to get the interest rate on it as on Post Office Savings Account for the next two years, but after two years this interest rate stops and your money in it. Remains lying.