Old Tax Slab vs New Tax Slab: Let’s know whether Old or New Tax Slab is better for an income of Rs 15 lakh? If your salary is also around this, then you can avail tax exemption under this formula…

Old Tax Slab vs New Tax Slab: The time has come to pay income tax, especially the employees working in private companies have started lobbying. Meanwhile, most of the employed people are still confused about whether they should go with the new tax slab or the old tax slab is best for them.

In fact, private companies have fixed a date for their employees to submit investment proof through e-mail to avail the benefit of tax saving, i.e. deduction. Now the employees have started weighing and measuring their salary.

According to the central government, up to 67 percent of taxpayers have adopted the new tax slab, because after many changes, the new tax slab is now proving to be a profitable deal. But will choosing the new tax slab actually lead to paying less tax as compared to the old tax slab, i.e. will more tax be saved with the new tax regime?

Today we will try to explain you an example that if your income is Rs 15 lakh, then which tax slab will be better for you?

According to the New Tax Slab, there is a provision of 30% income tax on income up to 15 years, whereas in the Old Tax Regime, 30% income tax is levied on income above Rs 10 lakh. In such a situation, there is a provision of 30% income tax in both tax regimes on an annual income of Rs 15 lakh.

First of all, let’s know whether Old or New Tax Slab is better for an income of Rs 15 lakh? If your salary is also around this, then you can avail tax exemption under this formula…

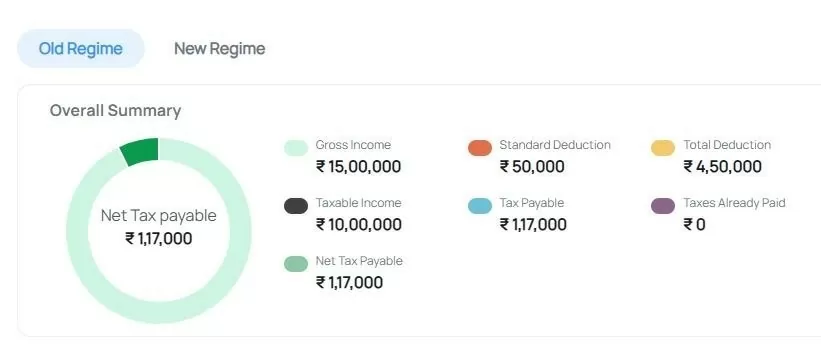

– In the old tax regime, a discount of up to Rs 50,000 is available under Standard Deduction. First of all, subtract it from your income. (15,00,000-50,000= Rs 14,50,000), that is, now Rs 14.50 lakh comes under the tax bracket.

– After that you can save Rs 1.5 lakh under 80C. For this, investment has to be made in EPF, PPF, ELSS, NSC. You can avail income tax exemption on an amount of up to Rs 1.5 lakh in the tuition fees of two children. Now you also subtract the income of Rs 1.5 lakh. (14,50,000- 1,50,000= Rs 13,00,000), now Rs 13.5 lakh comes under the tax net.

– If you invest Rs 50,000 annually in National Pension System (NPS) separately, then under section 80CCD (1B) you get help in saving additional Rs 50,000 in Income Tax. Now subtract this amount from your total income. (13,00,000-50,000= Rs 12,50,000), now your income of Rs 12.50 lakh comes under the tax net.

– Those with home loan can save additional Rs 2 lakh. If you have taken a home loan, then you can avail tax exemption on interest of Rs 2 lakh under section 24B of Income Tax. Subtract this also from your annual income. (12,50,000-2,00,000= Rs 10,50,000), now only Rs 10.50 lakh is taxable.

– By taking a medical policy under section 80D of Income Tax, you can save tax up to Rs 25,000. This health insurance should have your name, your wife’s name and your children’s name. Apart from this, if your parents are senior citizens, then you can get an additional deduction of up to Rs 50,000 by buying health insurance in their name. But if their age is less than 60, then you can claim up to Rs 25,000. Here we are assuming only Rs 25000. (10,50,000- 50,000 = Rs 10,00,000), that is, now an income of Rs 10 lakh comes under the scope of tax liability. According to the old tax regime, after this deduction, your income tax now becomes Rs 1,17,00.

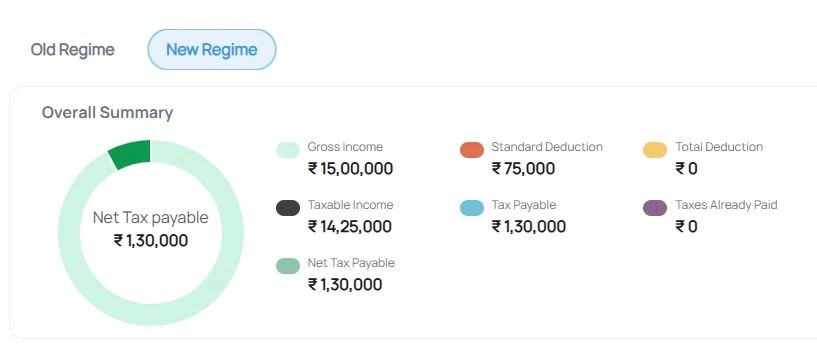

Now let us see in the New Tax Slab that if your income is Rs 15 lakh, then how much tax will be levied? According to the income tax rules, there is no deduction benefit in the new tax regime.

In such a situation, on an income of 15 lakhs, the taxpayer will get the benefit of standard deduction of only 75 thousand rupees in the new tax regime. In this way, first of all, subtract 75000 rupees from the income of 15 lakhs (1500000-75000 = 1425000 rupees). Now you can see with the help of income tax calculator that in the new tax regime, income tax of Rs 1,30,000 is due on an income of Rs 14.25 lakhs.

That is, if you take advantage of deduction by investing, then the old tax regime is still a profitable deal. Or you can say that the old tax regime is the best even on an income of 15 lakhs. However, for this you will have to claim a deduction of Rs 4.50 lakh, which has been explained in detail above.

If you do not make any investment, then under the old tax regime, income tax of about Rs 2,57,400 is payable on an income of 15 lakhs, in such a situation, the new tax slab will be a great option. Because without any investment, the income tax in the new tax regime is only Rs 1,30,000. That is, you can directly save income tax of Rs 1,27,400.