Employees who were appointed on or after 1st January 2004 and have withdrawn funds under NPS have been given relaxation in depositing the withdrawn amount.

Rajasthan OPS/NPS: There is a relief news for the government employees and pensioners of Rajasthan. Will the old pension scheme be discontinued or will it continue? Amidst the questions, the Bhajanlal government of the state has issued an order, which talks about giving relief to the employees who withdraw money deposited in the National Pension Scheme (NPS). At present, there are indications of continuing the Old Pension Scheme (OPS).

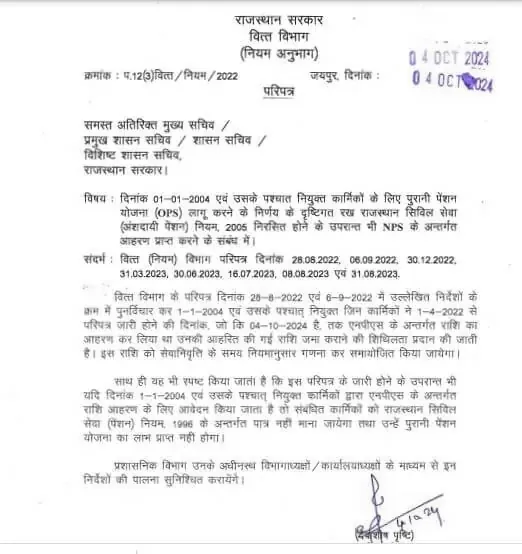

The order issued by the Finance Department states that the state employees who have withdrawn money under NPS, they will not have to deposit that money at present. The employees who were appointed on or after January 1, 2004 and had withdrawn the amount under NPS have been given relaxation in depositing the withdrawn amount, that is, now their withdrawn amount will be adjusted during retirement. It is also clarified in the order that if the personnel appointed on or after January 1, 2004 apply for withdrawal of amount under NPS, then the concerned personnel will not be considered eligible under Rajasthan Civil Services (Pension) Rules, 1996 and they will not get the benefit of old pension scheme.

Old Pension Scheme was restored in the previous government

The previous Gehlot government had implemented the system of giving OPS instead of NPS to the government employees appointed on 1 January 2004 and after that, after which NPS deduction from the employees was stopped. Let us tell you that 10 percent of the employee’s money was deducted in NPS, the same amount was deposited by the government. After the change of power, there was news that OPS may be stopped, but in the meantime, the Finance Department has issued a new circular, which is being considered a big indication of keeping OPS in force in the state.

Key points of OPS

- In OPS, after retirement of a government employee, half of the last basic salary and dearness allowance is given as pension from the government treasury for life.

- In OPS, dearness allowance is also increased twice every year, and providing pension to the family of the pensioner government employee on his death is also included in OPS.

- In OPS, employees get gratuity of up to Rs 20 lakh after retirement.

- In OPS, dearness allowance (DA) is applicable for employees after 6 months.

- The retired employee also gets the benefit of pension revision when the pension commission is implemented.

- In OPS, the employee does not have to pay any income tax on the interest of GPF on retirement.

Key points of NPS

- NPS is a contributory scheme, under which a government employee has to give 10% of his basic salary in his pension and the state government contributes only 14% in it.

- There is no permanent provision of gratuity at the time of retirement in NPS.

- Dearness Allowance (DA) which is received after 6 months is not applicable in New Pension Scheme (NPS).

- Under the new pension scheme, 40% of the NPS fund has to be invested to get pension on retirement. There is no guarantee of fixed pension after retirement.

- NPS is based on the stock market. There is no provision of dearness allowance in it.

- In NPS, there is a provision to give 50% of the total salary as pension to the family members of the employee in case of his death during service.

- In the new pension scheme, whatever money you get on retirement according to the stock market, you have to pay tax on it.