PNB Special FD Scheme: Punjab National Bank (PNB), one of the largest public sector banks in the country, has started a 600-day special FD scheme.

PNB Special FD Scheme: Punjab National Bank (PNB), which is one of the largest public sector banks in the country, has launched a 600-day special FD scheme. The scheme is being offered for FDs of up to Rs 2 crore for senior citizens aged 60 years and above and super senior citizens aged 80 years and above. This plan with FD of 600 days comes with callable and non-callable options.

PNB’s Special FD

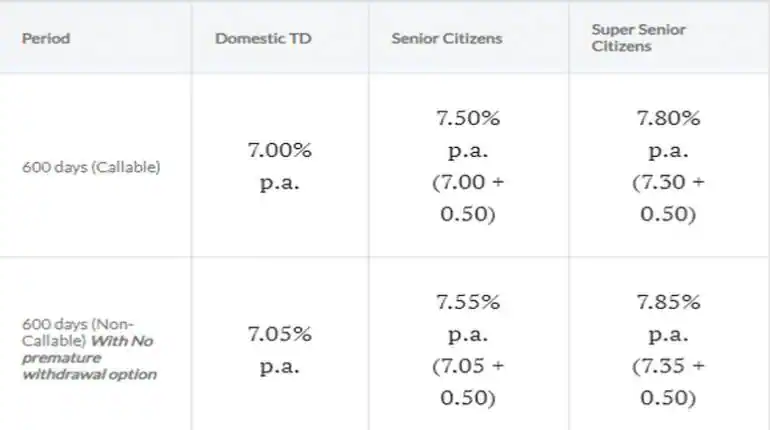

Under the callable option, PNB is paying an interest of 7.50 per cent to senior citizens and 7.80 per cent to super senior citizens. Under the non-callable option, the common people are getting an interest of 7.05 percent under FD. Under this option, senior citizens are getting 7.55 percent interest and super senior citizens are getting 7.85 percent interest. Now PNB is giving the highest interest of 7.85 percent on special FD. These new rates have come into effect from October 11.

PNB special offer

Speaking on the offer, Atul Kumar Goel, MD & CEO, Punjab National Bank said, “We aim to offer best in class offers to our customers. With such high FD rates, the bank is giving a good option to the customers. So that customers can earn the most out of their savings. Existing customers can avail this scheme through PNB ONE app and internet banking.

PNB is paying this much interest on special 600 days FD

These are the normal FD rates

7 days to 14 days: For general public – 3.50 per cent; For Senior Citizen – 4.00 percent

15 days to 29 days: For general public – 3.50 per cent; For Senior Citizen – 4.00 percent

30 days to 45 days: For general public – 3.50 per cent; For Senior Citizen – 4.00 percent

46 days to 90 days: For general public – 4.50 per cent; For Senior Citizen – 5.00 percent

91 days to 179 days: For general public – 4.50 per cent; For Senior Citizen – 5.00 percent

180 days to 270 days: For general public – 5.50 per cent; For Senior Citizen – 6.00 percent

271 days to less than 1 year: For general public – 5.50 per cent; For Senior Citizen – 6.00 percent

1 year: For general public – 6.30 per cent; For Senior Citizen – 6.80 percent

More than 1 year up to 599 days: For general public – 6.30 per cent; For Senior Citizen – 6.80 percent

600 days: For general public – 7.00 per cent; For Senior Citizen – 7.50 percent

601 days to 2 years: For general public – 6.30 per cent; For Senior Citizen – 6.80 percent

More than 2 years but less than 3 years: For general public – 6.25 per cent; For Senior Citizen – 6.75 percent

More than 3 years but less than 5 years: For general public – 6.10 per cent; For Senior Citizen – 6.60 percent

5 years to 10 years: For general public – 6.10 per cent; For Senior Citizen – 6.60 percent.