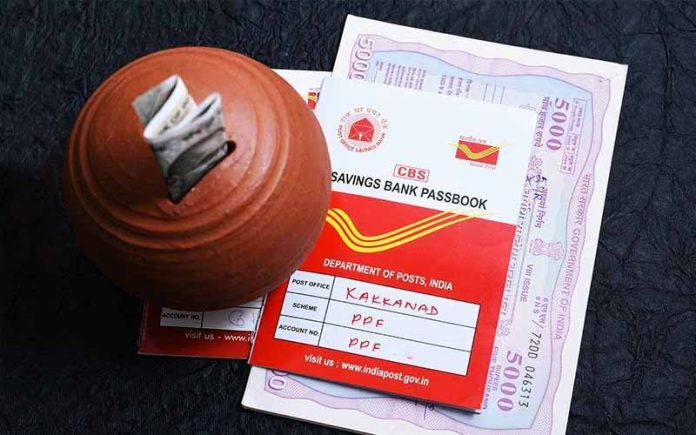

Post Office Scheme is a very good option for investment saving. Many people like to invest in post office schemes for tax saving. However, tax benefits are not available in some post office schemes. Today we will tell you in which schemes of the post office the benefit of tax exemption is not given.

New Delhi. Post office has become quite popular for investment. Tax benefits are available in many of their schemes. Investors can avail exemption of Rs 1.5 lakh under Income Tax Act 80C.

Let us tell you that the benefit of tax exemption is not given in some schemes of the post office. Many investors are not aware of this. Today we will tell you about those post office schemes in which the benefit of tax exemption is not available.

Mahila Samman Saving Certificate

Mahila Samman Saving Certificate is small saving. This scheme has been started especially for women. In this scheme, investors can invest up to Rs 2 lakh within 2 years. Interest is given at the rate of 7.5 percent on the investment amount. This scheme is not tax free. This means that there is no tax benefit under Section 80C of Income Tax.

National Saving Time Deposit Scheme

Investors also like the Post Office’s National Savings Recurring Deposit Scheme. 6.7 percent interest is offered in this scheme. In this, if you invest from 1 to 3 then you do not get tax exemption.

On investment for more than 5 years, you can avail tax exemption of Rs 1.50 lakh under Income Tax Act 80C.

Post Office Monthly Income Scheme

In this scheme you get income even after retirement. For this reason this scheme is quite popular. This scheme matures in 5 years. Please note that there is no tax benefit in the Post Office Monthly Income Scheme.

Kisan Vikas Patra Scheme

In Kisan Vikas Patra Scheme, the investor gets 7.50 percent interest. Guaranteed returns are available in this. Many investors like it because there is no risk. However, even in this scheme the investor does not get the benefit of tax exemption.