Post Office Monthly Income Scheme: In this great scheme of post office, not only the money is safe, but interest rate is also higher than that of banks. You can open a single or joint account in this scheme for 5 years investment.

Post Office schemes: Everyone saves some amount from their income and plans to invest it in such a place that not only a large fund is collected in the future but also a regular income is arranged after retirement. In this regard, Post Office Saving Schemes are quite popular. By investing in Post Office Monthly Income Scheme, you can get a regular income of Rs 9,000 every month.

Post Office schemes ahead in terms of safe investment

In terms of safe investment, Post Office Saving Schemes are very much liked in India. Along with this, there are schemes for every age group here, that is, from children to the elderly can take advantage of these schemes. It is also no less than anyone in terms of interest. Now talking about the Post Office Monthly Income Scheme (POMIS), it can prove to be a great option. After investing in this scheme, you will have a fixed income every month, and your money will also be completely safe.

Investment has to be made for 5 years

In this great scheme of Post Office, not only the money is safe, but the interest is also more than the banks. If you want to invest for 5 years, then this can prove to be a profitable deal. In the Post Office Monthly Savings Scheme, you can invest a minimum of Rs 1,000 and a maximum of Rs 9 lakh through a single account. If you open a joint account, then the maximum investment limit is fixed at Rs 15 lakh. That is, both husband and wife can invest up to Rs 15 lakh in a joint account. A maximum of three people can invest in a joint account.

You get this much interest on investment

If you want to arrange monthly income for yourself after or before retirement, then you can start investing in this scheme of the post office. The government is currently giving an annual interest of 7.4 percent in this saving scheme. Under the scheme, this annual interest received on investment is divided into 12 months and after this you keep getting this amount every month. If you do not withdraw the monthly money, then it will remain in your post office savings account and by adding this money with the principal, you will get interest further.

This way you will get more than 9000 rupees every month

Now if you want a regular income of more than Rs 9,000 every month, then for this you will have to open a joint account. Suppose you invest Rs 15 lakh in it, then the amount of interest you get at the rate of 7.4 percent annually will be Rs 1.11 lakh. Now if you divide this interest amount equally in 12 months of the year, then you will get Rs 9,250 every month. On the other hand, if you open a single account and start investing, then on the maximum investment of Rs 9 lakh in this scheme, you will get Rs 66,600 annually as interest, that is, an income of Rs 5,550 every month.

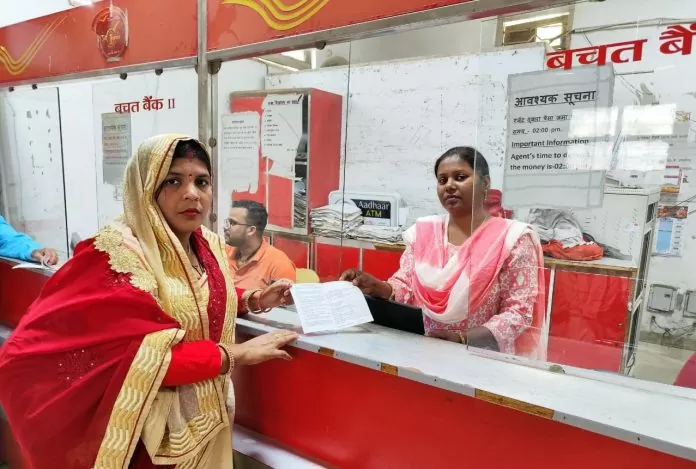

Where can I open a POMIS account?

Like other savings schemes of Post Office, opening an account in Post Office Monthly Income Scheme is also very easy. You can open this account by visiting your nearest post office. For this, you just have to fill a form for National Savings Monthly Income Account and deposit the fixed amount for opening the account along with the filled form through cash or cheque. To open an account in this scheme, you must have a PAN Card and Aadhaar Card.