Post Office Time Deposit is a scheme in which if you deposit Rs 5 lakh for five years, you will get only Rs 2.25 lakh as interest and on completion of the time, the entire Rs 5 lakh will be returned.

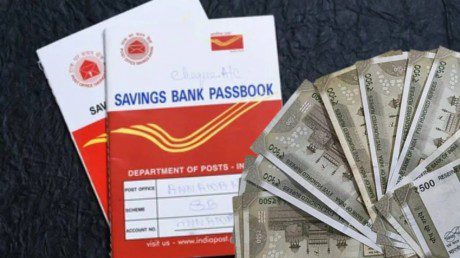

Post Office Time Deposits: Many small saving schemes are operated by the Post Office. We are going to tell you about such a scheme in which if you invest Rs 5 lakh, you will get only Rs 2.25 lakh as interest. On completion of the tenure of the scheme, the entire principal amount i.e. Rs 5 lakh will be refunded and the investor will also get tax benefit.

Invest for 4 different periods

The name of this scheme of Post Office is Post Office Time Deposit Account. In this, an investor can invest for 1 year, 2 years, 3 years and 5 years. According to the latest data, as of January 1, 2024, the interest rates are 6.9%, 7.0%, 7.1% and 7.5%. This interest rate will remain effective till March 31. Interest is revised every three months. Interest is calculated on quarterly basis and paid annually.

Interest of Rs 2.25 lakh on Rs 5 lakh

According to Post Office Time Deposit Calculator, if an investor invests money in this scheme for 5 years, then on the basis of 7.5 percent, the total interest amount in five years becomes around Rs 2.25 lakh. You can also call it Post Office Term Deposit Scheme. After completion of five years, the principal amount of Rs 5 lakh will also be returned to you.

Post Office Time Deposit Features

According to the information available regarding this scheme on the website of India Post, a minimum of Rs 1000 can be deposited and thereafter in multiples of Rs 100. You can open any number of time deposit accounts. Interest will be paid annually and you will not get any additional benefit on your interest amount after the due date. Tax benefit will also be available on the 5 year scheme which is available under section 80C. Premature closure can be done only after at least six months of account opening.