SBI PPF account Open: Public Provident Fund (PPF), the popular long-term savings scheme, which matures in 15 years is currently giving 7.1% interest annually. A PPF account can be opened in a Post Office. Even some banks like the State Bank of India (SBI) also provide the option of opening a PPF account. The account can be opened either by visiting the branch or online.

How to open SBI PPF account online explained in 10 steps

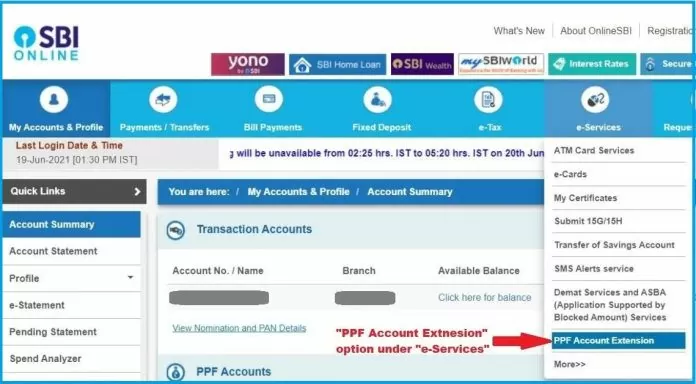

Steps 1 – Log in to your SBI online account

Steps 3 – Click and select the ‘new PPF Accounts’ option from the drop-down menu.

Steps 4 – You will be redirected to the ‘New PPF Account’ page. Existing customer details including PAN (Permanent Account Number) are displayed on this page.

Steps 5 – If you want to open an account in the name of a minor, then you need to check on that tab.

Steps 6 – If the account is not to be opened in the name of a minor, then you need to fill in the branch code in which you want to open your PPF account. Provide bank branch details.

Steps 7 – Your personal details – address and nomination- need to be verified. Once verified, click on ‘Proceed’.

Steps 8 – After submitting, a dialogue box says, ‘Your form has been successfully submitted’. It will also have the reference number.

Steps 9 – Now you need to download the form with the reference number given.

Steps 10 – Print the account opening form from the tab ‘Print PPF Online Application’ and visit the branch with KYC documents and a photograph within 30 days.

Requirements for opening SBI PPF account online

- The ‘Aadhaar’ number should be linked to your SBI savings account.

- Your mobile number linked to your Aadhaar should be in active status, to receive OTP.