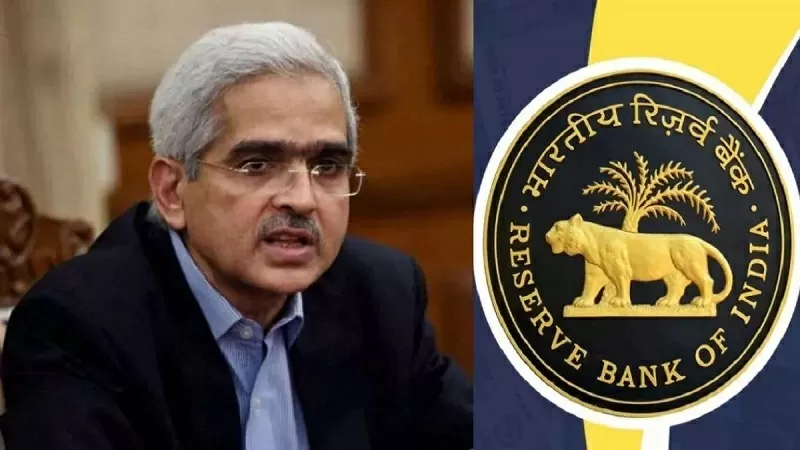

RBI has imposed penalty on four co-operative banks under the provisions of Section 47(a)(1)(c) read with Section 46(4)(i) and 56 of the BR Act.

RBI Action: Reserve Bank of India often takes action against banks in case of violation of rules. Earlier this week, RBI imposed a heavy penalty on four cooperative banks. These four banks are located in Gujarat. The names of these banks are Nagrik Sahakari Bank Limited (Babra), Sevaliya Urban Cooperative Bank Limited (Sevaliya District), Makarpura Industrial Estate Cooperative Bank Limited (Vadodara) and Gujarat Mercantile Cooperative Bank Limited (Ahmedabad).

Highest penalty on this bank

RBI has taken action against all these banks under the provisions of Section 47(a)(1)(c) read with Section 46(4)(i) and 56 of the BR Act. The highest penalty in this list has been imposed on Gujarat Mercantile Cooperative Bank Limited. The penalty amount is Rs 4.50 lakh. The bank failed to comply with the instructions of the Central Bank relating to “maintenance of deposits by primary co-operative banks with other banks” and “maintenance of cash reserve ratio”.

How much fine was imposed on other banks?

A fine of Rs 2 lakh each has been imposed on Makarpura Industrial Estate Cooperative Bank Limited and Nagrik Sahakari Bank Limited. Both banks failed to comply with rules relating to “loans and advances to directors, relatives and institutions in which they are interested”. Nagarik Co-operative Bank Limited also violated RBI regulations issued on “Placement on Deposits of Other Banks by Primary (Urban) Co-operative Banks (USBs) and “Interest Rate on Deposits”. Apart from this, a fine of Rs 50 thousand has been imposed on Sewalia Urban Co-operative Bank Limited for violating the instructions related to “loans and advances to directors, relatives and entities in which they are interested”.

Customers will not face any problem

The Reserve Bank has made it clear that this action has been taken in view of the shortcomings of the banks. This will not have any impact on the transactions taking place between customers and banks.