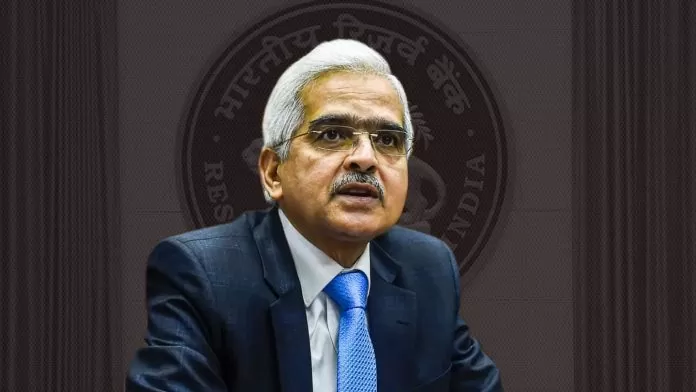

Reserve Bank of India Governor Shaktikanta Das informed about the decisions taken in the MPC meeting today. This time also it has been decided to keep the repo rate stable. Let us tell you that RBI has taken a big step to bring transparency in loans. All lenders will be required to offer KFS for both personal and small and medium enterprise (MSME) loans.

Mumbai: The Reserve Bank of India (RBI) on Thursday took a big step for those taking loans from banks. The Reserve Bank of India (RBI) has ordered all lenders to provide “Key Fact Statement” (KFS) to borrowers for both personal and small and medium enterprise (MSME) loans.

Till now, KFS was required only for loans given by commercial banks to individual borrowers, digital lending by RBI-regulated entities (REs) and microfinance loans. The KFS will contain information about the terms of the loan agreement, including the total interest cost.

RBI Governor said that KFS will have proper information related to interest due to which the loan taking customers will be able to take appropriate decisions.

RBI took steps to bring transparency in loans

The Reserve Bank Governor said the central bank has announced a number of measures in recent times to promote greater transparency by regulated entities (REs). One such measure is that loan providers will be required to provide their customers with a KFS containing important information regarding the loan agreement in a simple and easy to understand format.

Additionally, they also announced new options to hedge gold price risk, including allowing shortlisting of gold prices in the over-the-counter (OTC) market at the International Financial Services Center (IFSC) in GIFT City. Is included.

Das said this decision has been taken to avoid fluctuations in the price of gold in the OTC segment in IFSC. The Central Bank will issue related instructions separately.

RBI also announced a review of the regulatory framework for electronic trading platforms (ETPs). The RBI Governor said that over the last few years, there has been increased integration of the ‘onshore forex’ market with the ‘offshore’ market, significant evolution in the technological landscape and increased product diversity.

Das also announced RBI’s intention to enhance the security features of the Aadhaar-linked payment system (APS), which was used by 37 crore people by 2023.