RBI has canceled the license of another government bank. “Banking business” of the bank will be restricted from today. It will not be allowed to transact.

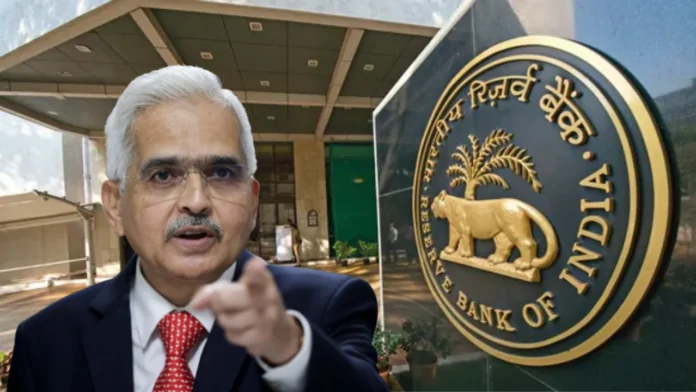

RBI Canceled License Of Bank: Reserve Bank of India has taken action against banks in the beginning of the week itself. RBI has canceled the license of The Kapol Co-operative Bank Limited (Mumbai, Maharashtra). The order has also been issued on Monday 25th September. From today the bank will not be allowed to do transactions.

Why did RBI cancel the bank’s license?

RBI said that this cooperative bank has adequate capital and earning potential. The Kapol Co-operative Bank Limited is also unable to make full payments to its depositors with the current financial condition. In this situation, there is a violation of the provisions of Section 11 (1), Section 22 (3) (d) along with Section 56 of the Banking Regulation Act 1949. Apart from this, the Reserve Bank said, “The survival of the bank is harmful for its depositors.” The bank will no longer be allowed to accept deposits and repay deposits.

What will happen to customers’ money?

The license of this cooperative bank located in Mumbai has been cancelled. Despite this, each depositor can claim deposits up to Rs 5 lakh under the Deposit Insurance and Credit Guarantee Corporation (DICGC). Claiming more deposit amount than this will not be allowed. According to the data, currently about 96.09% customers are entitled to receive the full amount of deposits from DICGC.