RBI Repo rate: At the beginning of 2022, the repo rate was 4 percent. It has increased to 6.5 percent. Due to this, the EMI of many people taking home loan has increased so much that they are facing difficulty in repaying it. Such people are waiting for reduction in repo rate.

RBI Repo rate: The EMI of your home loan is not going to decrease at the moment. The reason is that RBI has not changed the repo rate in its monetary policy on April 5. It has been maintained at 6.5 percent. This was the seventh consecutive monetary policy when the central bank did not change the repo rate. Due to this, people taking home loans will have to wait a little longer for the interest rates to reduce. However, it was already believed that the Central Bank would not change the repo rate in the monetary policy of April.

Home loans of most banks are linked to repo rate.

Banks use an external benchmark for interest rates on all types of loans, including home loans. Most banks use repo rate as an external benchmark. This means that when the repo rate increases, the interest on home loan increases. When the repo rate decreases, the interest rate on home loan decreases. There is no change in the interest rate of home loan if there is no change in the repo rate.

Repo rate will reduce only after inflation comes down

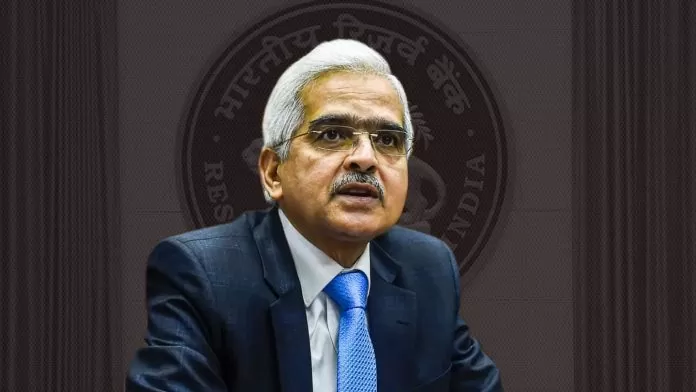

Home loan customers will have to wait for their EMIs to be reduced until inflation comes within the range set by RBI. Retail inflation is still higher than the RBI’s target of 4 percent. RBI Governor Shaktikanta Das told about this while presenting the monetary policy on April 5. In 2022, central banks around the world including RBI started making loans expensive after the increase in inflation. For this he started increasing the repo rate. At the beginning of 2022, the repo rate was 4 percent, which later increased to 6.5 percent.

Option to switch loan is open

At the beginning of 2021 and 2022, the home loan interest rate was around 6.5 percent. Then the repo rate was 4 percent. This means that the home loan interest rate was 2.5 percent more than the repo rate. Now, if the home loan interest rate increases too much, customers have the option to transfer their home loan to a bank whose interest rate is lower. But, it is not right to do this in haste. It is important for the customer to think carefully before switching loans.

Loans from private banks are expensive

This year, HDFC Bank has increased its home loan interest rates by 35 basis points despite there being no increase in the repo rate. The interest rate for home loan of Rs 50 lakh in HDFC Bank was 8.35 percent in January. Now it has increased to 8.70 percent. According to Paisa Bazaar data, Axis Bank and Karur Vysya Bank have increased their home loan interest rates by 5 basis points.

Home loans of many government banks linked to MCLR

Experts say that people taking home loans can pre-pay the loan to reduce the EMI burden. For this you can use your savings or investment money. If you pre-pay some part of your loan for a few months, your EMI will reduce significantly. Another option is to switch your home loan to a government bank. The reason for this is that even now many government banks decide their home loan interest on the basis of old benchmarks like MCLR.