RBI Monetary Policy: Today the monetary policy of the Reserve Bank of India was announced, after which it was decided not to make any change in the repo rate for the fifth consecutive time.

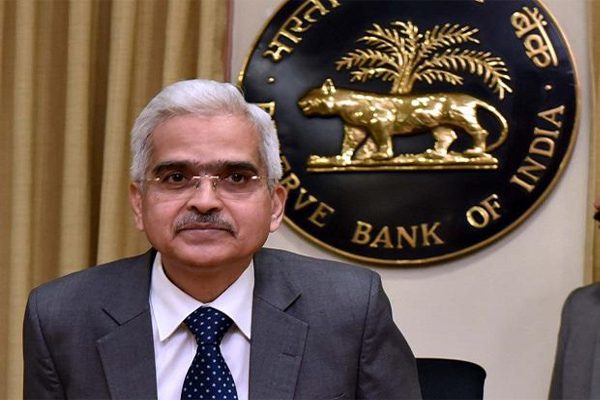

RBI Monetary Policy: For the fifth consecutive time, Central Bank Governor Shaktikanta Das has not made any change in the repo rate. Today the monetary policy of the Reserve Bank of India was announced, after which it was decided not to make any change in the repo rate for the fifth consecutive time. Let us tell you that 5 out of 6 members decided in favor of not making any change in the repo rate. This time also the repo rate will be at 6.50 percent. This means that due to no change in the repo rate, customers’ personal loans, car loans or other types of loans will not be affected.

GDP figures better in the second quarter

Reserve Bank (RBI) Governor Shaktikanta Das announced the monetary policy today (8 December). RBI Governor has not made any change in interest rates. The repo rate has been maintained at 6.5 percent. RBI has kept interest rates unchanged for the fifth consecutive time. GDP figures in the second quarter (Q2FY24) were better than expected.

GDP growth estimate increased

Governor Shaktikanta Das also released the GDP growth estimate. It has been decided to increase the GDP growth estimate for the financial year 2024 from 6.5 percent to 7 percent. Apart from this, the GDP growth estimate for the third quarter has been kept at 6.4 percent. Let us tell you that it has been decided to increase the GDP estimate for the financial year 2024 from 6 percent to 6.4 percent. Let us tell you that 5 out of 6 members were in favor of withdrawing the accommodative stance for the change in repo rate. All MPC members were in favor of keeping the rates stable.

Growth of 8 core industries is better

While announcing the monetary policy, RBI Governor Shaktikanta Das said that the Indian economy is continuing to grow due to domestic demand and the growth of 8 core industries is improving in October. Apart from this, the manufacturing sector has strengthened due to reduction in input costs and improvement in rural demand is being seen. The pace of investment has increased due to government spending and domestic consumption has increased due to festive demand.

Rising sugar prices a matter of concern

RBI Governor Shaktikanta Das said that the rise in sugar prices is a matter of concern. Apart from this, RBI has also released the inflation estimate. The CPI estimate for FY24 is retained at 5.4% and the CPI estimate for Q3FY24 is retained at 5.6%. Whereas Q1FY25 CPI estimate remains at 5.2% and Q3FY25 CPI estimate has been fixed at 4.7%. RBI’s efforts are continuing to bring the inflation rate to 4%.