RBI Monetary Policy latest update: Regarding RBI policy, this time also experts are expressing the possibility that there will be no change in the repo rate. But, now the question is that if the repo rate is not cut this time too, then when will it happen?

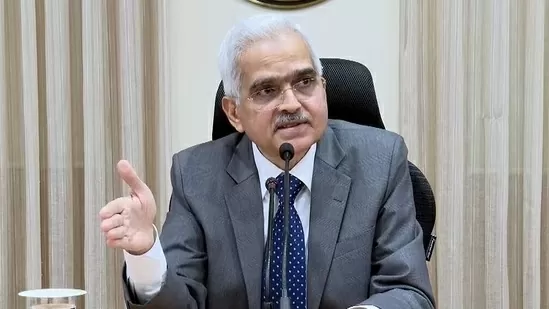

RBI Monetary Policy latest update: Monetary policy meeting of the Reserve Bank is going on. Repo rates i.e. interest rates will be reviewed in the meeting. On April 5, 2024, Reserve Bank Governor Shaktikanta Das will announce the decisions taken in the meeting. The current repo rate is 6.5 percent. This time also the question is the same in people’s minds. Will RBI reduce the EMI burden this time? Will the repo rate be cut or not? What will be the stance of RBI regarding inflation? What will the Reserve Bank predict about the economy? What is the expert’s opinion amidst all these questions?

When will the repo rate be cut?

Regarding RBI policy, this time also experts are expressing the possibility that there will be no change in the repo rate. But, now the question is that if the repo rate is not cut this time too, then when will it happen? And how many times the total cuts are expected in the year 2024. For this, first of all let us understand the polling done by experts.

1) Is a rate cut expected from this policy?

Yes-

No- 100%

2) If not in April, when will RBI cut rates?

A) June Policy

B) August Policy

C) October Policy 100%

D) After October Policy

3) By how much do you expect rate cuts in calendar 2024?

One 60%

Two 40%

Three

More than Three

4) Do you expect any cut in CRR in this policy?

A) Yes

B) No 100%

5) Do you expect RBI to revise GDP forecast?

Yes 60%

No 40%

6) Do you expect RBI to change its inflation forecast?

Yes

No 100%

So when will we get the first gift of rate cut?

According to the poll conducted on Reserve Bank policy, experts believe that there will be no rate hike in the policy of April and June. But, there will be full hope of reduction in repo rate in the October policy. The Reserve Bank will examine the situation for two quarters now. After this, the first gift of rate cut can be received in the policy of October 2024. This gift will also be special because it will be the festive season. In such a situation, getting relief on home loan before Diwali can bring great relief.