Shaktikanta Das: For the financial year 2024-25, RBI has projected the growth rate of real GDP i.e. at base price to be 7.2 percent. He said, ‘This growth outlook shows the strength of India’s macroeconomic fundamentals.

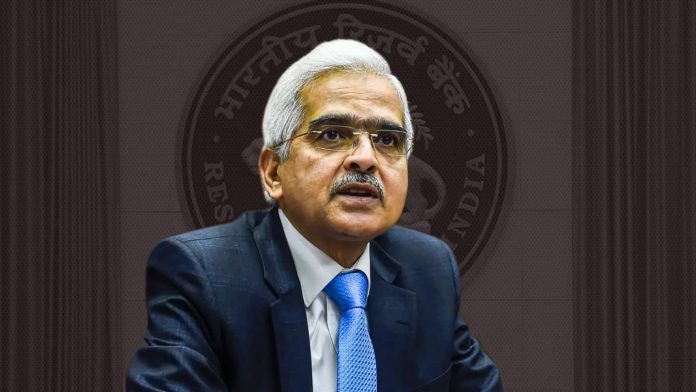

RBI Repo Rate: Reserve Bank of India Governor Shaktikanta Das said amid softening of inflation that policymakers should remain firm. He indicated that he is not in favor of changing the policy too soon. He said that the country’s growth outlook reflects the strength of the country’s macroeconomic foundation. He said that elements like private consumption and investment are playing an important role in this. He said at the ‘Future of Finance Forum 2024’ organized by the Bretton Woods Committee, Singapore that the country’s economic growth is supported by the environment of macroeconomics and financial stability.

GDP estimated to be 7.2 percent

Das said that the Indian economy has recovered from the crisis caused by the Kovid-19 epidemic. During the year 2021-24, the average GDP growth rate was more than 8 percent. For the financial year 2024-25, the RBI has projected the growth rate of real GDP i.e. at base prices to be 7.2 percent. He said, ‘This growth outlook shows the strength of India’s macroeconomic fundamentals. In this, domestic elements – private consumption and investment – are playing a major role.’

Inflation remained below 4 percent in August

Das said about inflation that it has come down from 7.8 percent in April 2022 to the range of two to six percent. But ‘we still have a distance to go and we cannot afford to look the other way.’ The governor said that the Reserve Bank’s estimates indicate that the inflation rate may come down to 4.5 percent in 2024-25 and 4.1 percent in 2025-26. It was 5.4 percent in 2023-24. CPI (CPI) based retail inflation remained below the Reserve Bank’s target of 4 percent for the second consecutive month in August at 3.65 percent. In July it was at a five-year low of 3.6 percent. ‘Companies’ performance improved

He said, ‘Fiscal consolidation continues and the level of public debt is declining in the medium term. The performance of companies has improved, which has reduced their loans and made strong growth possible due to profits. The governor said that the ledger of banks and NBFCs regulated by RBI has also strengthened. He said, ‘Our testing shows that these financial units will be able to maintain regulatory capital and cash requirements even in severe stress scenarios.’

No change in repo rate for 18 months

Shaktikanta Das said that emerging markets including India can take advantage of the slowdown in price rise. The Federal Reserve is expected to provide relief in interest rates. His comment came at a time when the RBI has not made any change in the repo rate for more than 18 months. Shaktikanta Das warned against any reduction and said that unstable food costs remain a threat to inflation. Experts do not expect the RBI to reduce the repo rate till the last quarter of the year. It is being estimated that the RBI will move forward only after the change by the US Fed Reserve.