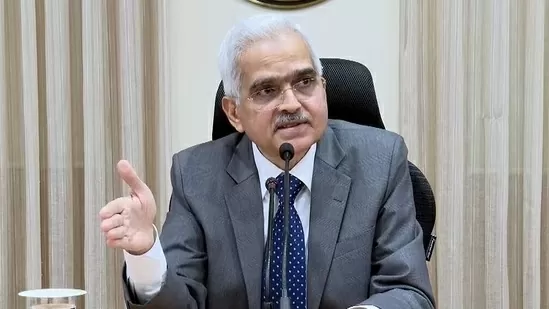

Paytm Crisis: Reserve Bank of India (RBI) Governor Shaktikanta Das refused to review any action taken against Paytm Payments Bank.

New Delhi: Ever since the Reserve Bank of India has imposed a ban on Paytm Payments Bank (RBI Paytm Ban), the problems of the company have increased. At the same time, users using Paytm Payments Bank are also in confusion. Because there are many such questions which are running in the minds of people. However, now you do not need to worry. This week, RBI will issue a FAQ (list of frequently asked questions) addressing various issues related to customers regarding Paytm Payments Bank Ltd.

In the 606th meeting of the Central Board of Directors of RBI, Governor Shaktikanta Das said, “Wait for the FAQs.” In this, there will be clarification of matters related to PPBL customers (Paytm Crisis). Our priority is that customers should not be inconvenienced. Customer interest and interest of depositors are of paramount importance for us.

What will be the effect of ban on Paytm?

On January 31, RBI took a major action against Paytm Payments Bank (Ban on Paytm Payments Bank), asking it to stop accepting deposits or ‘top-up’ to any customer account, wallet, Fastag and other products after February 29. Gave instructions. RBI has also directed to close the ‘nodal accounts’ of One97 Communications Limited, the operator of Paytm brand. However, RBI has allowed interest deposit, cashback or ‘refund’ even after February 29.

Will be able to use the money deposited in the account

Apart from this, PPBL customers will be allowed to withdraw or utilize the money deposited in their accounts including Savings Bank Account, Current Account, Prepaid Products, Fastag and NCMC up to their available balance without any restriction.

Action for continued failure to comply with regulations

The Reserve Bank has taken this action against PPBL (Paytm Payments Bank RBI Ban) for continuously failing in regulatory compliance. Earlier, on March 11, 2022, it had stopped PPBL from adding new customers with immediate effect.

Can the February 29 deadline be extended?

When asked whether the deadline of February 29 will be extended? Governor Shaktikanta Das said, “Wait for the FAQ.” He said, “Don’t expect the review of RBI decision in the FAQ. The FAQ will resolve issues related to depositors, customers, wallet users, Fastag holders. Whatever is in the interest of the customers, we are working on the FAQ.

Decision taken keeping in mind the interests of customers

Reserve Bank of India (RBI) Governor Shaktikanta Das on Monday ruled out any review of the action taken against Paytm Payments Bank. He said that this decision has been taken after a comprehensive assessment of the functioning of PPBL and keeping in mind the interests of the customers.

Shaktikanta Das said, “At this time I want to clearly say that there will be no review of the decision in the PPBL case. If you are expecting a review of the decision, let me make it clear that there will be no review of it.

The Governor said that any decision against financial institutions coming under the purview of RBI regulation is taken only after a comprehensive assessment. He said that RBI has been supporting the fintech sector, but at the same time it is also committed to protecting the interests of customers and ensuring financial stability.